NFT and crypto buying and selling analytics web site DappRadar made a shocking announcement yesterday. Throughout a bear market, merchants poured over $311m of gross sales quantity into digital worlds in Q1 2023. What helped trigger this surge in shopping for digital world NFT initiatives?

Picture Credit score: DappRadar

What brought about $311m in gross sales quantity for digital worlds in Q1?

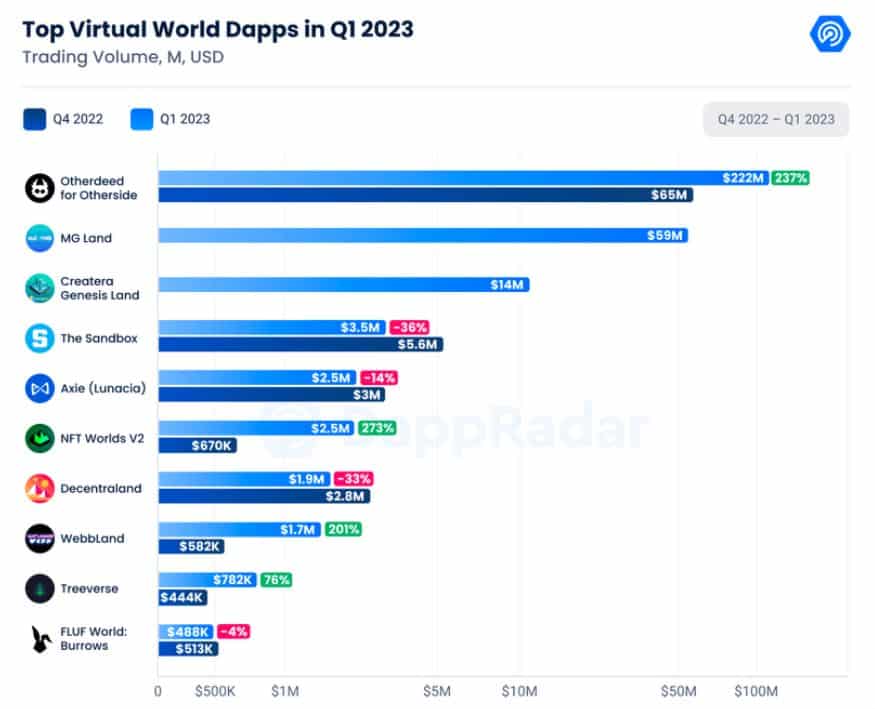

DappRadar attributes nearly all of the record-breaking gross sales quantity to Yuga Lab’s Otherside. The metaverse NFT challenge noticed $222m of buying and selling quantity, good for a rise of 237% in buying and selling quantity over the earlier quarter.

This market frenzy got here after Yuga Lab’s introduced a date for its “Second Trip” into the Otherside. The NFT group will get a brand new take a look at their upcoming metaverse on March 25. The earlier sneak peek was successful, and lots of merchants are betting that Yuga may even impress with tomorrow’s second glimpse into the Otherside.

NFT buying and selling on Blur can also be answerable for the excessive buying and selling quantity, DappRadar stories. The disruptive NFT platform injected tons of of thousands and thousands of {dollars} into the NFT ecosystem with its last airdrop, and the window to qualify for his or her subsequent spherical of airdrops is operating now. To qualify, merchants should bid on collections and checklist NFTs near challenge flooring. Free cash is at all times a compelling proposition. Not surprisingly, merchants are shopping for in by flooding Blur’s order books with market exercise.

Airdrop farmers focused one challenge particularly, for instance. MG Land, a metaverse challenge that permits customers to fulfill mates and play video games of their digital world, registered over $60m of buying and selling quantity in Q1. This $60m quantity was larger than the volumes of well-known digital land initiatives Axie Infinity, Sandbox, and Decentraland.

NFT merchants used Blur’s zero royalty platform to clean commerce MG Lands belongings forwards and backwards. Many critics pointed to MG Land’s buying and selling exercise for example of synthetic market dynamics created by Blur’s airdrop marketing campaign, complaining that the patrons and sellers had little interest in the precise challenge itself.

These claims do appear appropriate. Blur turned off the power for merchants to earn factors by shopping for and promoting MG Land, and the challenge’s ground instantly crashed to .03 eth after reaching a excessive of .15 eth in early March.

What does the longer term maintain for NFT buying and selling in digital worlds?

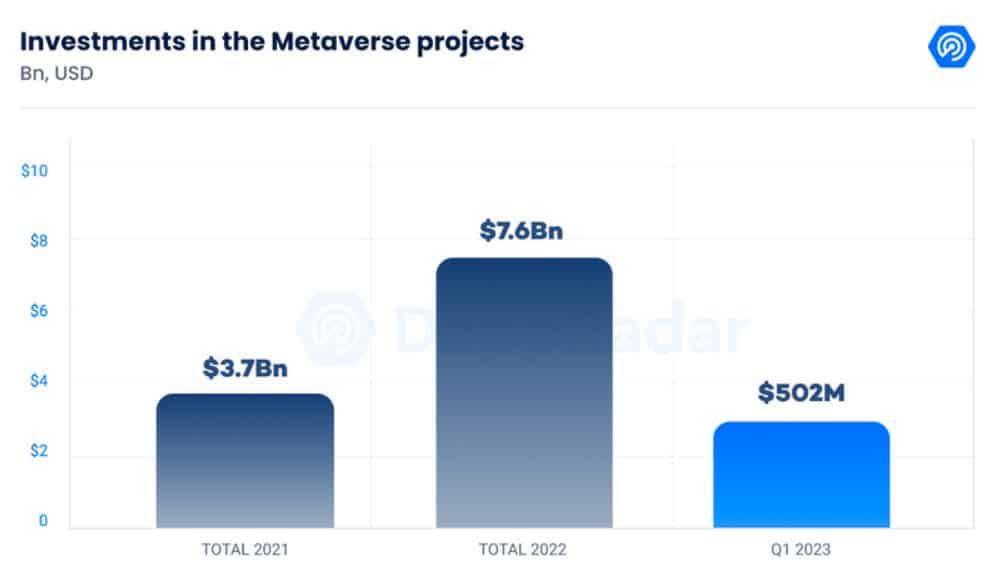

The buying and selling quantity for digital worlds doesn’t appear to be an remoted phenomenon. In 2021, traders put $3.7b of funds into metaverse and blockchain gaming initiatives. That quantity nearly doubled to $7.6b in 2022. This 12 months has been tough for markets. Many economists are predicting worldwide recessions as central banks wrestle to scale back inflation amidst meltdowns within the banking trade. With over $500m invested in Q1 2023, nevertheless, there appears to be loads of urge for food for publicity to the rising sectors of metaverse initiatives and blockchain gaming.

Picture Credit score: Dappradar

Humanity appears destined to turn out to be extra digitally native over time as a species. It appears inevitable, due to this fact, that we’ll be spending increasingly time in digital worlds. As we achieve this, we’ll additionally proceed to put an rising quantity of emphasis on proudly owning digital belongings in our metaverses. For these causes and as knowledge from DappRadar signifies, it’s clear that buying and selling NFTs in digital worlds initiatives will proceed to be an enormous enterprise.

All funding/monetary opinions expressed by NFTevening.com aren’t suggestions.

This text is academic materials.

As at all times, make your individual analysis prior to creating any sort of funding.