PLUS: In crypto markets, there is a mini-rally in bitcoin, a narrowing of the “Grayscale low cost” and a rally in altcoins.

Good morning. Right here’s what’s taking place:

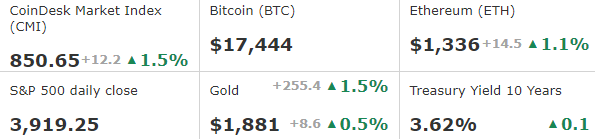

Costs: As bitcoins nudges increased above $17,400, altcoins are surging and the so-called “Grayscale low cost” is narrowing due to rising hypothesis over Digital Currency Group’s funds.

Insights: Indonesia’s authorities is launching a crypto alternate. But it surely’s not utterly appropriate to suppose that it’s launching a competitor to Binance.

Costs

BTC/ETH costs per CoinDesk Indices; gold is COMEX spot value. Costs as of about 4 p.m. ET

Bitcoin crosses above $17.4K, however Verify Out GALA

By Bradley Keoun

The digital-asset evaluation agency Arcane Analysis famous that bitcoin’s gains are getting eclipsed as “market individuals rotate into altcoins amidst a frantic quick squeeze.”

Markets analyst Glenn Williams Jr. wrote Tuesday that he is all of a sudden seeing an uptick in exercise in a technical display screen he makes use of to establish cryptocurrencies with rising volatility. It is particularly stunning given how lacking volatility was for the previous couple of weeks, as chronicled in a weekly report Tuesday by Glassnode.

The drama surrounding Digital Foreign money Group (proprietor of CoinDesk) continues, and the hypothesis could be seen within the latest narrowing of the so-called “GBTC low cost” to an eight-week low.

Insights

Indonesia’s Authorities-Run Crypto Alternate Isn’t What You Assume it Is

By CoinDesk Indonesia and Sam Reynolds

Indonesia’s authorities is launching a crypto alternate. But it surely’s not utterly appropriate to suppose that it’s launching a competitor to Binance.

Inside Indonesia, crypto exchanges like Binance are known as “Bodily Merchants of Crypto Belongings” by the nation’s Commodity Futures Buying and selling Regulatory Company, additionally identified by its Indonesian acronym BAPPEBTI.

Behind the scenes there are a selection of different entities which are particular to the nation which are much like the infrastructure present in conventional finance.

BAPPEBTI is the regulatory physique that oversees crypto buying and selling in Indonesia. That is the chart of the Indonesian crypto buying and selling ecosystem.

there are 4 essential gamers/pillars pic.twitter.com/hciX3dfWMy

— Coinvestasi (@coinvestasi) January 4, 2023

When authorities in Indonesia consult with “crypto exchange,” it means one thing nearer to a pricing reference index such because the NASDAQ composite.

That is one pillar within the buying and selling infrastructure ecosystem, alongside aspect nationally regulated custodians — bear in mind: post-Mt. Gox nationwide custodian guidelines are why FTX Japan customers are whole — and a futures clearing home.

On one hand, that is how crypto buying and selling goes mainstream in Indonesia and turns into an institutional grade asset. Its solely with laws and infrastructure akin to TradFi that establishments can really spend money on the asset class.

However then again, crypto does lose a few of its attraction if it is as regulated and managed as equities. There are potentialities that the federal government may implement issues like buying and selling hours (which might be powerful to do for crypto) and restrictions on value actions.

BAPPEBTI has but to launch a timeline as to after they count on this to be accomplished. The regulator says they’re nonetheless engaged on constructing out this infrastructure, and is focusing on a launch date someday this yr.

This complete system and infrastructure would be the first of its sort on the planet. And Indonesia, given its scale, is a superb place to place this to the take a look at.

Vital occasions

9:30 a.m. HKT/SGT(1:30 UTC) Germany’s 10-y Bond Public sale

11:30 p.m. HKT/SGT(15:30 UTC) Australia’s Commerce Stability (Mother/Nov)

6:00 a.m. HKT/SGT(22:00 UTC) China’s Overseas Direct Funding (YoY/Dec)