Bitcoin Present Is Slowly Exhibiting Dispersal In path of Smaller Holders

In response to a model new report printed by the on-chain analytics company Glassnode, patrons holding decrease than 50 BTC haven’t too way back absorbed most likely probably the most very important amount of money.

One factor that BTC critics usually preserve up in opposition to the cryptocurrency is the distribution of the supply. They argue that the supply is carefully concentrated spherical just some whales, providing the existence of giant wallets as proof.

To look at whether or not or not this reality holds, Glassnode studied the supply distribution of the market by breaking down patrons into completely totally different cohorts. These holder groups are outlined by the analytics company as follows: shrimp (<1 BTC), crab (1-10 BTC), octopus (10-50 BTC), fish (50-100 BTC), dolphin (100-500 BTC), shark (500-1,000 BTC), whale (1,000-5,000 BTC), and humpback (>5,000 BTC).

The gives held by exchanges and miners are moreover thought-about for the classification. A associated indicator proper right here is the “yearly absorption costs,” which measures the yearly change inside the gives of the completely totally different cohorts as a share of the general amount of issued money (that’s, the current present miners produce).

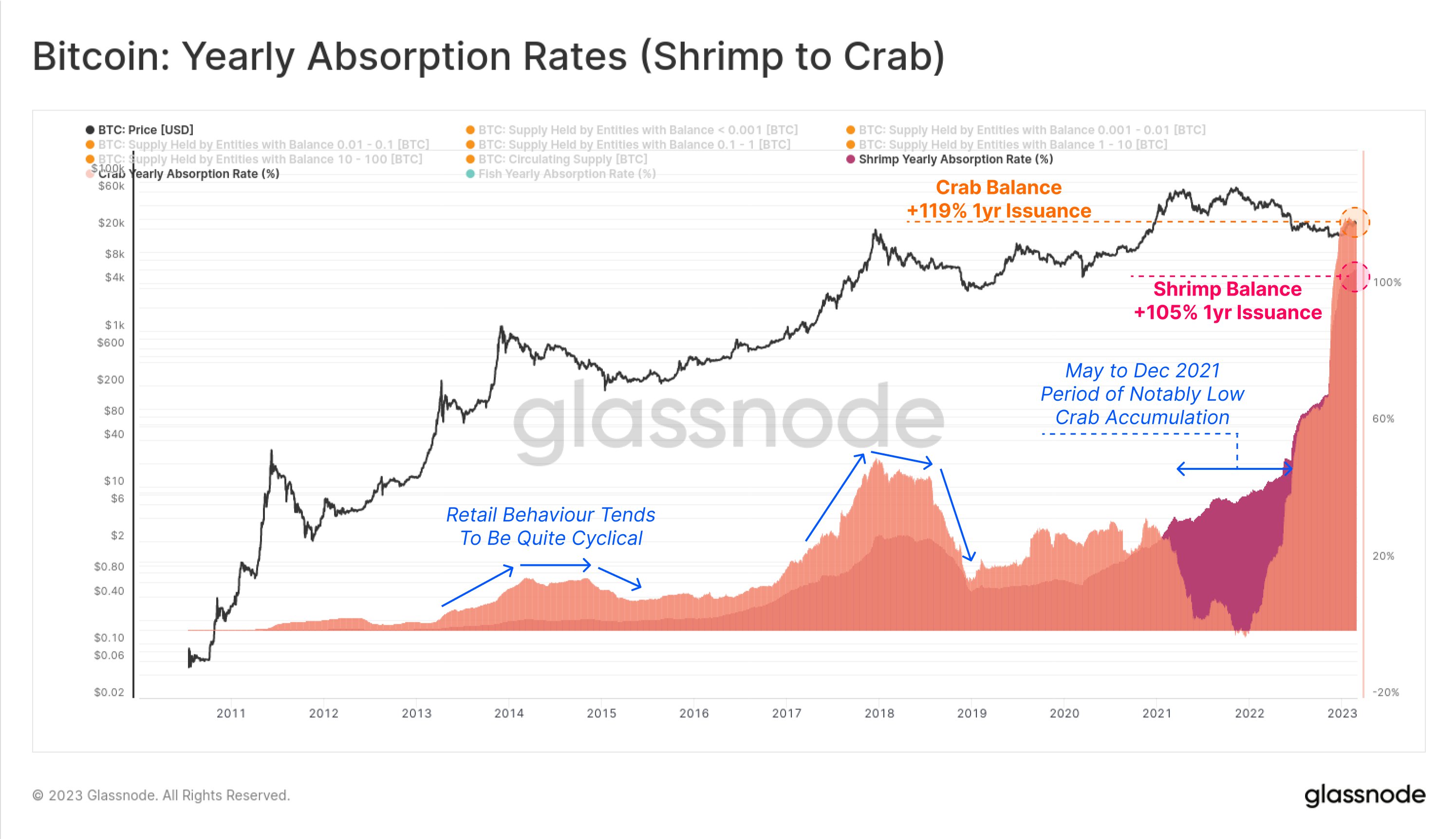

First, right here’s a chart that reveals how the yearly absorption costs of shrimps and crabs have modified over the lifetime of the cryptocurrency:

Appears identical to the metrics have confirmed extreme values in present days | Provide: Glassnode

As displayed inside the above graph, the Bitcoin shrimps and crabs haven’t too way back been observing all-time extreme absorption costs of about 105% and 119%, respectively.

Which signifies that the supply held by the shrimps has grown by 105% of what miners produced by the earlier 12 months, whereas the crabs have added an far more very important share at 119%.

Even when the BTC miners launched 100% of what they mined the earlier 12 months, these cohorts nonetheless have absorbed an extra present. The place did these additional money come from? The absorption costs of the alternative cohorts may preserve the reply to it.

The absorption costs of the sharks and whales | Provide: Glassnode

From the chart, it’s apparent that sharks have had a barely constructive yearly absorption cost not too way back. Nonetheless, the whales have seen a harmful indicator price, implying that this cohort has been distributing by the earlier 12 months.

The blended change inside the gives of every these cohorts may also be an online damaging given that distribution of the whales far outweighs whatever the sharks accrued all through this period.

Info for the absorption costs of the exchanges moreover reveals damaging values, implying that these platforms have launched many money into circulation.

The extraordinarily damaging absorption costs confirmed by exchanges | Provide: Glassnode

The smaller Bitcoin entities have been choosing up the money distributed by these cohorts. Curiously, whereas this shift inside the present has been extreme not too way back, it’s a sample that has held up all by the years.

As a result of the chart beneath highlights, the supply held by smaller entities (with decrease than 50 BTC) has step-by-step gained dominance all by the cryptocurrency’s historic previous.

The rise of the shrimps and totally different small patrons | Provide: Glassnode

Though the share of the whales might have been pretty very important in the end, proper now, their holdings have shrunk all the way down to solely 34.4% of the entire circulating present, which, although nonetheless sizeable, is much lesser than the 62.7% throughout the time of the first halving, the events that decrease downs BTC mining rewards in half, once more in 2012.

The gradual present shift moreover seems to be within the path of the smallest entities, which are the retail patrons. It’s a sign that cryptocurrency is popping into additional dispersed as adoption will improve.

BTC Worth

On the time of writing, Bitcoin is shopping for and promoting spherical $24,300, up 10% inside the ultimate week.

BTC observes a pullback | Provide: BTCUSD on TradingView

Featured image from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Glassnode.com