Bitcoin Transaction Rely Has Observed A Sharp Improve Not too way back

In step with data from the on-chain analytics company Glassnode, the BTC blockchain train has significantly gone up simply recently. The indicator of curiosity proper right here is the “transaction rely,” which measures the entire number of Bitcoin transactions occurring on the neighborhood correct now.

When the value of this metric is extreme, it means the chain is seeing a extreme amount of utilization from the holders. This form of sample suggests retailers are energetic on the market correct now.

Then once more, low values of the indicator suggest the BTC blockchain is seeing low train at current. Such a sample is often a sign that the general curiosity throughout the asset is low amongst merchants in the meanwhile.

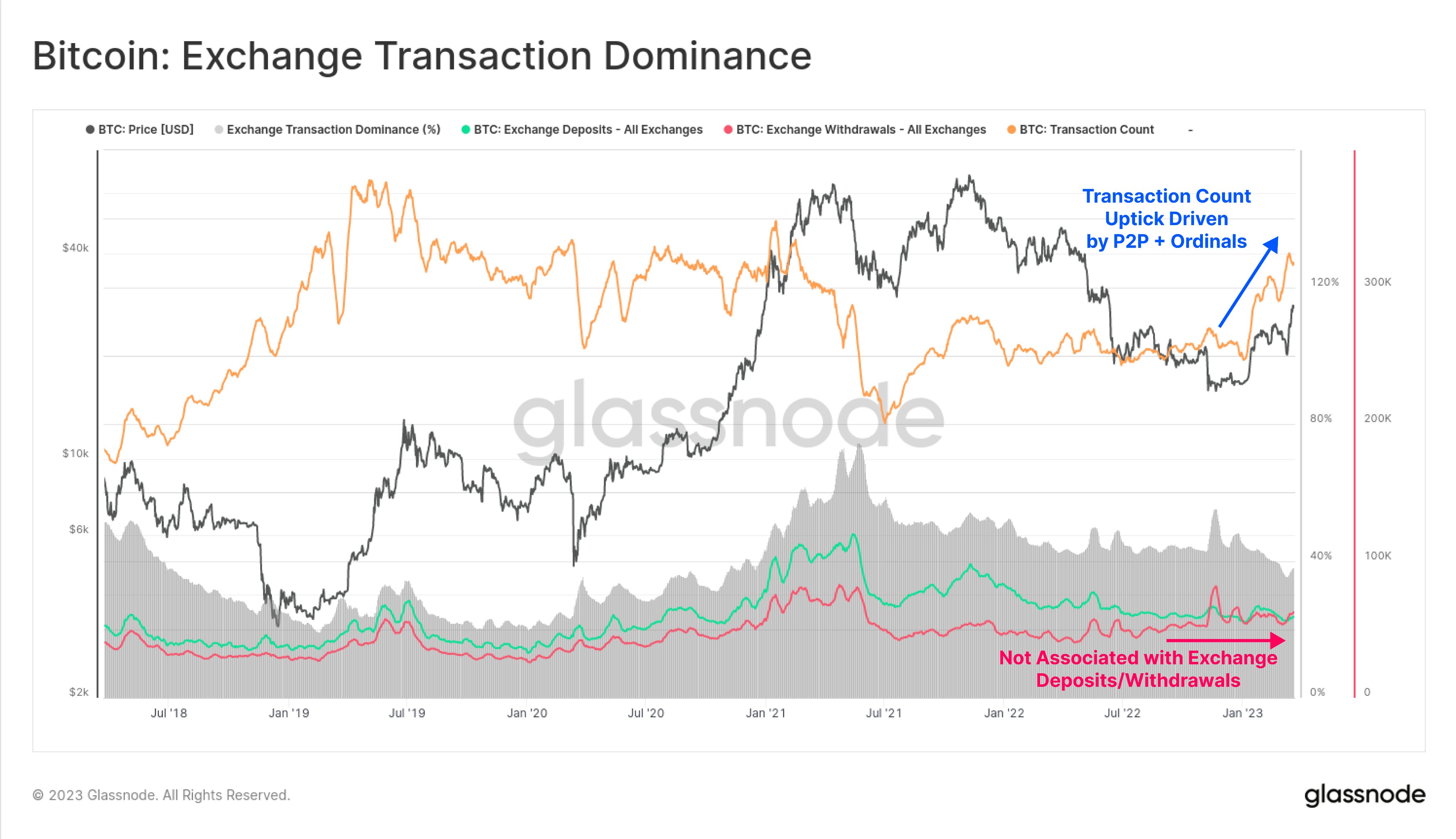

Now, right here’s a chart that reveals the sample throughout the Bitcoin transaction rely over the previous few years:

The value of the metric seems to have seen a sharp rise in newest weeks | Provide: Glassnode on Twitter

As confirmed throughout the above graph, the Bitcoin transaction rely had gone stale after the plunge the place the cryptocurrency had descended from the bull rally prime. This sample remained true all by way of the bear market until the rally started this 12 months.

With this latest worth surge, the indicator has shot up and has hit ranges which were solely closing seen in the middle of the bull run throughout the first half of 2021. Which implies the number of transfers occurring on the chain correct now’s one of the best in about two years.

The chart moreover reveals data for two totally different indicators, the Bitcoin alternate deposits and alternate withdrawals. As a result of the names of these metrics already point out, they inform us regarding the entire amount of transfers going in and out of exchanges, respectively.

These metrics are to not be confused with the inflow and outflow indicators, as a result of the latter ones measure the entire number of money flowing into and out of exchanges, pretty than the transaction rely.

From the graph, it’s seen that whatever the spike throughout the Bitcoin transaction rely, these two metrics have continued to maneuver sideways. Which implies the rise in transfers has just about absolutely come from the peer-to-peer (P2P) aspect and by no means exchanges.

That isn’t like what was seen in the middle of the April 2019 rally and 2021 bull run, the place the exchange-related transactions moreover observed a minimal of some rise along with the worth improve.

Given that Ordinals protocol, a way of inscribing data instantly into the Bitcoin blockchain (principally the BTC mannequin NFTs), has moreover seen emergence in the middle of the most recent months, part of the rise throughout the transaction rely might be going pushed by such transfers made using this protocol.

BTC Worth

On the time of writing, Bitcoin is shopping for and promoting spherical $28,200, up 14% throughout the closing week.

BTC hasn't moved rather a lot simply recently | Provide: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com