Join the most important conversation in crypto and web3! Secure your seat today

Good morning. Right here’s what’s occurring:

Costs: Bitcoin and ether started the enterprise day in Asia within the crimson.

1,061

−13.0 ▼ 1.2%

$22,795

−899.4 ▼ 3.8%

$1,568

−70.8 ▼ 4.3%

S&P 500

4,017.77

−52.8 ▼ 1.3%

Gold

$1,937

+8.4 ▲ 0.4%

Nikkei 225

27,433.40

+50.8 ▲ 0.2%

BTC/ETH costs per CoinDesk Indices, as of seven a.m. ET (11 a.m. UTC)

Insights: Centralized trade tokens’ good points are an unlikely story given the issues with FTX’s FTT token. What’s subsequent?

Costs

By Sam Reynolds

Bitcoin-Tech Inventory Correlation to Be Examined Once more as Wall Road Kicks Off Earnings Season

Bitcoin and ether started the enterprise day in Asia within the crimson, with the world’s largest digital asset down just under 4% on-day to $22,795 and the latter down 4.8% to $1,568. Buyers are eyeing a busy week within the U.S. with an underwhelming earnings week anticipated, in addition to one other rate of interest hike.

“The This autumn earnings season for the S&P 500 continues to be subpar,” wrote FactSet analyst John Butters in a observe printed earlier. “Whereas the variety of S&P 500 firms reporting optimistic earnings surprises elevated over the previous week, the magnitude of those earnings surprises decreased throughout this time. Each metrics are nonetheless beneath their 5-year and 10-year averages.”

Refinitiv data exhibits that analysts anticipate S&P 500 earnings reported this week to say no 3%, with tech down 8.7%.

Buyers are additionally trying to one other – however smaller – rate of interest hike this week, with the outcomes of the final Fed assembly popping out on Wednesday. Buyers imagine the Fed will hike charges by 25 foundation factors (bps) which might be the smallest fee improve in nearly a yr.

All of this continues to test the correlation bitcoin is reported to have with the inventory market.

“There doesn’t appear to be any indication that crypto will cease transferring in response to Fed coverage selections, although Ethereum’s upcoming Merge is likely one of the extra vital occasions in crypto’s current historical past,” Riyad Carey, analysis analyst at Kaiko, instructed CoinDesk in a beforehand offered observe.

Insights

Centralized Alternate Tokens Submit Stable Positive factors in January Regardless of SEC Curiosity

By Sam Reynolds

The digital property market is having a report January, and also you’d be forgiven if you happen to thought the bear market was over. Bitcoin is up almost 40% because the starting of the yr, and ether has gained 30%, with altcoins also showing some strength.

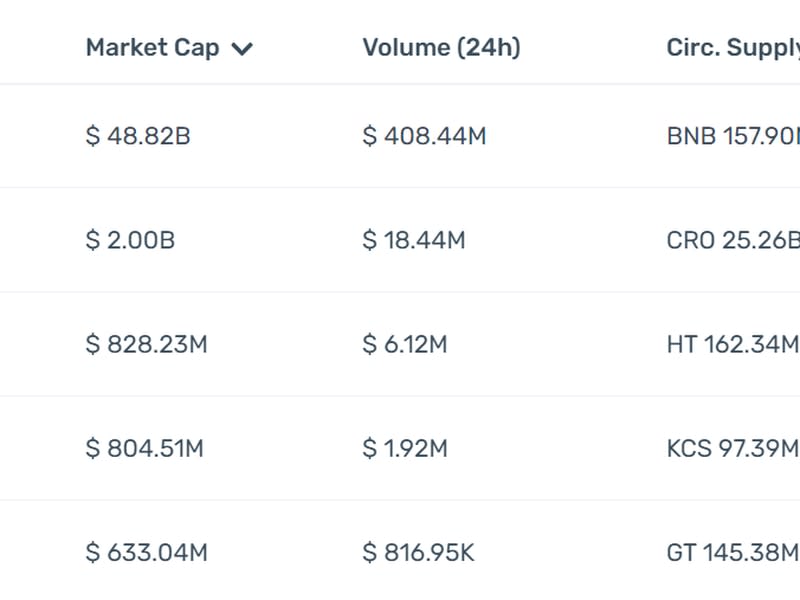

Alternate tokens are additionally following this development and have posted double-digit development over the last month. Binance’s BNB, Crypto.com’s CRO, and KuCoin’s KCS are all squarely within the inexperienced.

Usually this wouldn’t be a lot of a shock, because the rise of those tokens correlates with a rise in quantity on exchanges. Proper now, it’s a wholesome, vibrant market, and trade token costs mirror this.

However that is forgetting what occurred within the final days of December.

As part of a complaint filed in opposition to FTX co-founder Gary Wang and former Alameda Analysis CEO Caroline Ellison, the Securities and Alternate Fee (SEC) laid out the case as to why FTX’s former trade token, FTT, is a safety.

“If demand for buying and selling on the FTX platform elevated, demand for the FTT token might improve, such that any worth improve in FTT would profit holders of FTT equally and in direct proportion to their FTT holdings,” the SEC wrote in its grievance. “The big allocation of tokens to FTX incentivized the FTX administration staff to take steps to draw extra customers onto the buying and selling platform and, due to this fact, improve demand for, and improve the buying and selling worth of, the FTT token.”

This might describe many – however not all – of the trade tokens available on the market. And since Ellison has signaled her intent to cooperate with regulation enforcement, the SEC’s claims weren’t contested. When this was unsealed in December, it ought to have been a day of reckoning for the trade token sector.

OKX, as an illustration, particularly shies away from that description of its trade token.

“The native token was by no means a giant a part of our enterprise or treasury. Our native token was all the time designed to interact our most lively clients and provides them a option to search reductions via exercise on the platform,” is how an OKX govt described the token in an interview with CoinDesk.

The same can’t be said about Huobi, which CryptoQuant knowledge exhibits is the exchange most reliant on its own token.

The market might have priced in the concept the SEC may not be capable to do lots about the way it thinks trade tokens are securities.

Exchanges that supply these tokens don’t have a lot of a nexus to the U.S. They’re situated offshore, not run by Individuals, and don’t permit U.S. residents on the platform.

However BitMex additionally thought it was protected from U.S. regulatory oversight by doing the identical factor, and we all know how that turned out.

Essential occasions.

8:30 a.m. HKT/SGT(00:30 UTC) Australia Retail Sales s.a. (MoM/Dec)

3:00 p.m. HKT/SGT(7:00 UTC) Germany Retail Sales (YoY/Dec)

5:00 p.m. HKT/SGT(9:00 UTC) European Central Bank Lending Survey

CoinDesk TV

In case you missed it, right here is the latest episode of “First Mover” on CoinDesk TV:

An enormous week in markets because the U.S. Federal Reserve meets to resolve how excessive to lift rates of interest amid indicators of decrease inflation and a cooling economic system. Coinbase Institutional Head of Analysis David Duong joined “First Mover” to debate. Johns Hopkins Univ. Professor of Utilized Economics Steve Hanke weighed in along with his recession outlook. Additionally chapter professional Dov R. Kleiner of Kleinberg Kaplan joined to debate the newest within the FTX, Celsius, and Voyager chapter instances. Plus, crypto trade Gemini is reportedly underneath investigation over FDIC claims.

Headlines

Sandbox’s SAND Surges 90% Since Start of Year Ahead of Token Unlock: The unlock, scheduled for mid February, will launch 12% of the token’s provide.

Crypto-Focused VC Firm Pantera’s Liquid Token Fund Lost 80% in 2022: The fund took a 23% hit in November within the aftermath of FTX’s collapse.

Elon Musk Wants Twitter Payments System to Accommodate Crypto, FT: DOGE spiked on the information.

BlockFi’s Crypto Mining Assets May Be Headed to Market After Bankruptcy Hearing: The crypto lender’s quest to get its palms on $580 million of Robinhood shares initially owned by FTX founder Sam Bankman-Fried has taken one other flip, the court docket was instructed.

Binance Partners With Mastercard to Launch Prepaid Crypto Card in Brazil: The cardboard will permit funds with 13 cryptocurrencies, together with bitcoin, ether and Binance USD.