- Ethereum worth has nosedived to $1,527, as merchants interact in large revenue taking beginning January 20.

- ETH has dominated 21% of the discussions on social media platforms as profit- taking transaction ratio spiked.

- Ethereum worth may gain advantage from the worry, uncertainty and doubt surrounding the asset on crypto neighborhood boards.

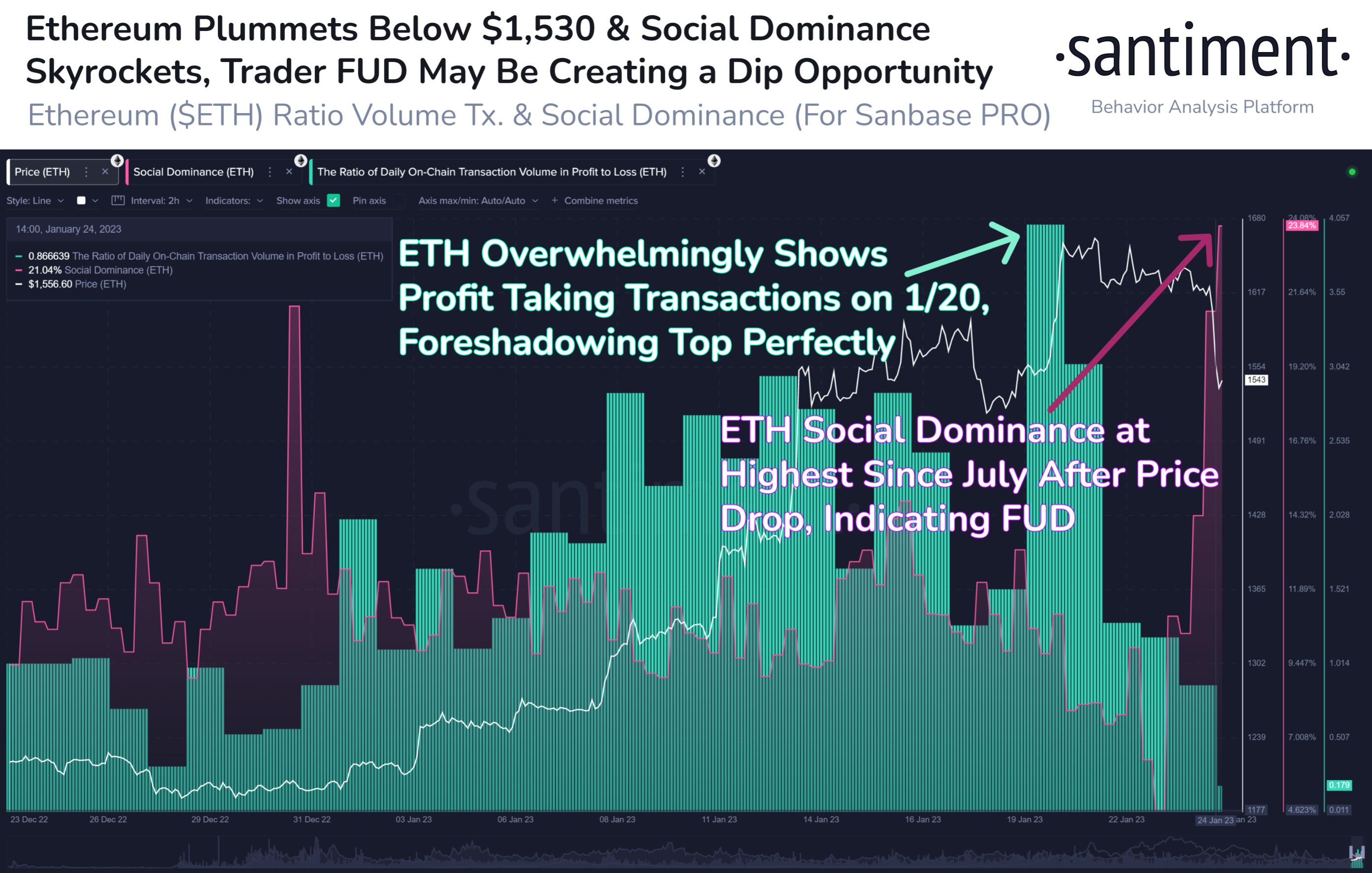

Ethereum worth plummeted to $1,527 after hitting the latest excessive of $1,638. Specialists at crypto information aggregator platform Santiment famous that the large profit-taking transaction ratio spiked on January 20.

The altcoin was mentioned in 21% of the conversations on social media platforms. Analysts at Santiment consider the FUD surrounding ETH might gasoline a bullish narrative for the asset within the mid-term.

Additionally learn: Here’s how Vitalik Buterin’s privacy solution could be a game changer for Ethereum and privacy coins

Ethereum merchants interact in mass revenue taking pushing ETH worth decrease

Ethereum worth worn out its losses from the FTX trade collapse and made a comeback above the $1,600 degree on January 20. This coincided with a rise in profit-taking by ETH holders.

Specialists on the crypto intelligence platform Santiment famous a large spike within the profit-taking transaction ratio. This coincided with a rise in social dominance of the second-largest cryptocurrency by market capitalization.

Ethereum social dominance spikes, worth drops beneath $1,530

ETH was the subject of debate in 21% of the conversations on crypto Twitter and different social media platforms. The Worry, Uncertainty and Doubt (FUD), and the hype surrounding the asset may gain advantage its worth within the mid-term, based on Santiment analysts.

The way to spot and revenue from Ethereum whales shedding their holdings

The substitute inflation of an asset’s worth is named a “pump.” A pump implies that the market will quickly expertise a downturn and the chance vs. reward of shopping for the asset doesn’t make it a worthwhile funding.

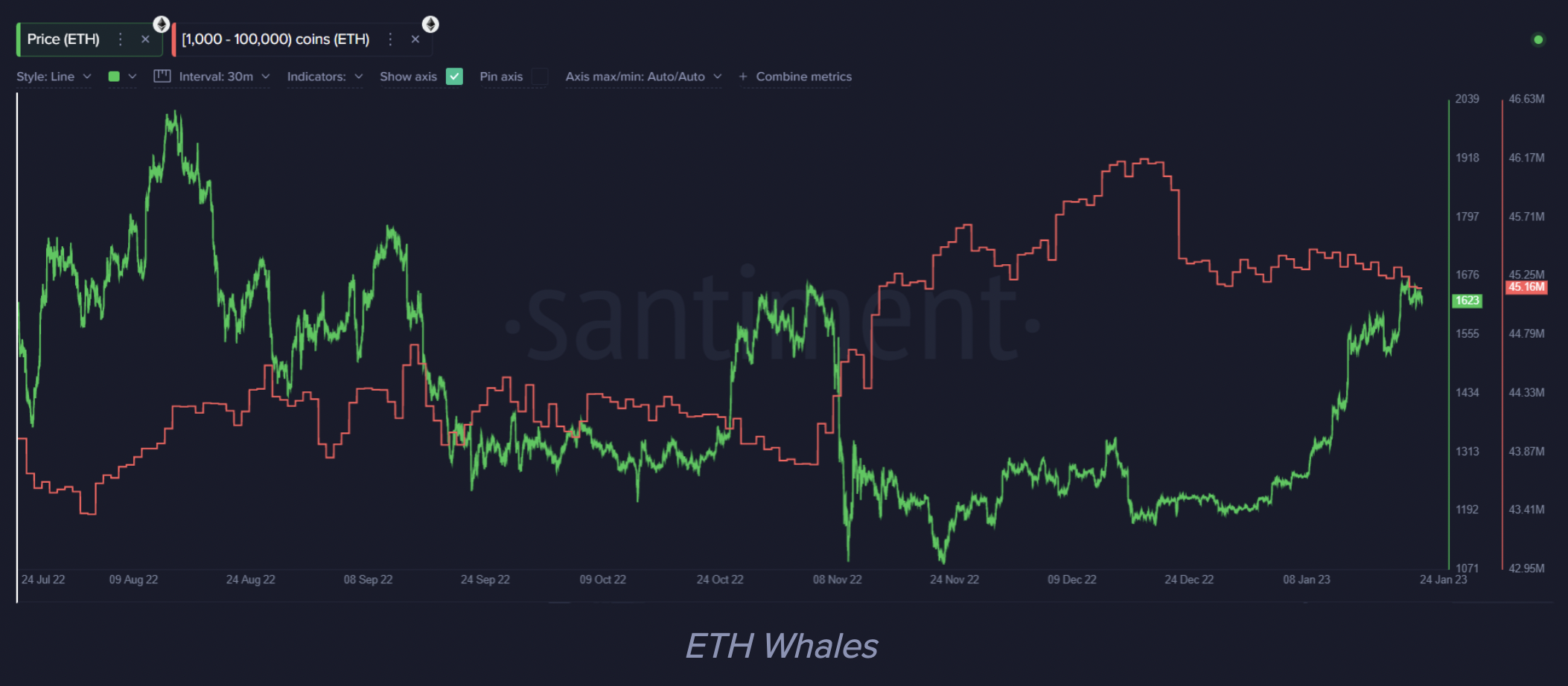

To identify “pumps” it’s helpful to take a look at the conduct of enormous pockets traders, often called whales. In case of Ethereum, whales holding between 1,000 and 100,000 ETH began shedding their holdings persistently all through January 2023 – an indication of a possible “pump”.

ETH whales

ETH whales

This means that market contributors have to train warning and look ahead to higher “purchase” alternatives quite than leaping right into a doubtlessly unstable commerce.

Ethereum worth might witness a run as much as $2,000 if Bitcoin bulls make a comeback

Technical analysts argue that Ethereum worth might hit the bullish goal and the psychologically vital $2,000 degree if Bitcoin bulls make a comeback. Ethereum has loved a excessive correlation with Bitcoin, at 0.83. Due to this fact a bullish breakout in Bitcoin might set off a rally within the altcoin.

Akash Girimath, technical analyst at FXStreet argues that Ethereum worth might set off one other run-up regardless of the plain exhaustion. Such a transfer will retain the bearish divergence however will enable market makers to gather the buy-stop liquidity resting above $1,679 and entice the early bears.

ETH/USDT worth chart

ETH/USDT worth chart

Throughout this liquidity hunt, ETH worth might lengthen as excessive as $2,000. A decline beneath the 200-day Exponential Transferring Common (EMA) at $1,509 might invalidate the bullish thesis for ETH.