(Kitco News) – As was widely expected, Hong Kong approved its first spot bitcoin and ether exchange-traded funds (ETFs) on Monday, according to a Reuters report.

The move positions Hong Kong to establish itself as the first jurisdiction in Asia to accept the two largest cryptocurrencies as a mainstream investment tool.

The report said at least three offshore Chinese asset managers are set to launch BTC and ETH spot ETFs in the near future, with the Hong Kong units of Harvest Fund Management and Bosera Asset Management saying in separate statements they had received conditional approvals from the Hong Kong Securities and Futures Commission (SFC) to launch the funds.

“The introduction of the virtual asset spot ETFs not only provides investors with new asset allocation opportunities but also reinforces Hong Kong’s status as an international financial centre and a hub for virtual assets,” Bosera Asset Management said in a statement. Bosera will launch the ETFs in partnership with Hong Kong-based HashKey Capital.

Harvest Global Investments CEO Han Tongli said the conditional approval will contribute to the company’s goal to promote industry innovation and meet investor demand.

ChinaAMC (HK), the Hong Kong unit of China Asset Management, also announced on Monday that it had received regulatory approval to provide virtual asset management services, and the firm is also developing spot ETFs for both assets.

The SFC told Reuters it issues a conditional authorization letter to an ETF application if it generally satisfies its requirements, subject to various conditions, including fee payments, filing of documents, and the Hong Kong Stock Exchange’s (HKEX) listing approval. The regulator did not comment on the details of any virtual asset spot ETFs.

The approval comes just three months after the U.S. authorized the launch of its first spot bitcoin ETFs, which have already seen roughly $12 billion in net inflows since they began trading. Cryptocurrencies are still banned in mainland China, but Hong Kong has been promoting the city as a global hub for do dedo asset development and trading.

Hong Kong is competing with Singapore and Dubai to establish itself as a hub for do dedo asset firms. The region introduced its regulatory framework for virtual-asset service providers in June and has made notable efforts to engage the retail public in the cryptocurrency ecosystem.

Three futures-based crypto ETFs – CSOP Bitcoin Futures, CSOP Ether Futures, and Samsung Bitcoin Futures – are already listed on the Hong Kong market and currently have combined assets of approximately $170 million.

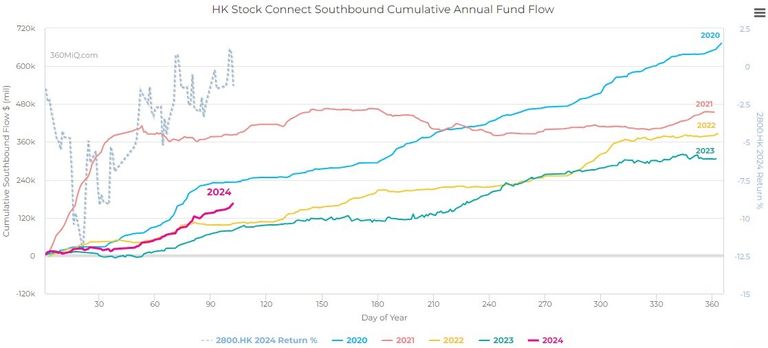

According to a Friday report from Singapore-based crypto services provider Matrixport, the launch of spot BTC ETFs in Hong Kong could unlock up to $25 billion in demand from Chinese investors via the Southbound Stock Connect program, which allows qualified mainland Chinese investors to access eligible shares listed in Hong Kong.

“Based on the (potential) available capacity, this might result in up to 200 billion Hong Kong dollars of available capacity for those HK Bitcoin ETFs—or US$25 billion,” Matrixport said.

The estimate is based on the assumption that the average amount of the unused annual Southbound connect quota over the past three years would be channeled into the spot ETFs, they noted.

Data provided by 360MarketIQ shows that over the past three years, flows in the Stock Connect program have been HK$450 billion, HK$400 billion, and HK$320 billion, while the program allows mainland Chinese investors to purchase up to HK$540 billion worth of Chinese stocks annually.

“Hence, there is potentially HK$100 billion to HK$200 billion in quota left for Bitcoin ETF investment flows – if the approval occurs without any restrictions,” Matrixport said. “HK$200 is the equivalent of $25 billion.”

While it’s unclear whether Chinese investors will be able to invest in the funds, mainland China has shown interest in diversifying into alternative assets amid economic uncertainty, a struggling real estate market, and a 2% decline in the value of the yuan against the U.S. dollar.

“China’s RMB is at a 17-year low vs. the USD,” Matrixport said. “Indeed, there is a demand for diversification,” they added, citing the ongoing gold purchases by the Chinese mediano bank.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.