Whereas the DAO has but to formally see the Lido proposal to permit withdrawals from stETH, Galaxy Digital has already been essential. The Lido governance token has fallen about 15% from its excessive final week week.

Good morning. Right here’s what’s occurring:

Costs: Bitcoin and different cryptocurrencies closed a profitable January. Will the rest of the Yr of the Rabbit within the lunar zodiac see the momentum proceed?

Insights: A Lido DAO proposal faces criticism, even earlier than it is formally introduced. Lido’s governance token is down. What’s subsequent?

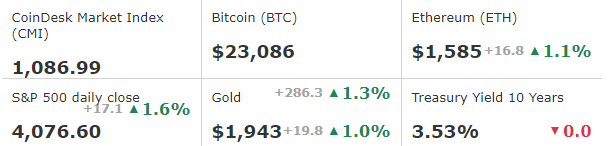

BTC/ETH costs per CoinDesk Indices; gold is COMEX spot worth. Costs as of about 4 p.m. ET

Bitcoin Finishes January up 40% as Crypto Hops Into the Yr of the Rabbit

By Sam Reynolds

Joyful February.

Bitcoin is at $23,129, up 1.3% within the final 24 hours whereas ether is up 1.2% to $1,586.23.

The 2 largest digital belongings wrapped up a monumental January, beating expectations, by posting double-digit beneficial properties – Bitcoin by 40% and ether by 32%.

January additionally proved to be the season of the altcoins with Cardano (ADA) up 56%, Dogecoin (DOGE) up 37%, Solana (SOL) up 140%, and Avalanche (AVAX) up 82%.

Whereas most crypto buyers want to the inventory market and U.S. central financial institution assembly minutes for steerage, only for a minute we’d wish to – for a way of levity – look to the heavens to see what the celebs would possibly inform us.

Most of East Asia has returned to work from celebrating the Lunar New Yr. Within the Lunar zodiac, 2023 is the yr of the rabbit, and legend says this yr must be as calm, peaceable and tender because the animal itself.

CLSA, a serious brokerage primarily based in Hong Kong, wrote in a be aware printed in January that every one macro economic indicators level to this yr as being one the place the market “hops” round.

“Mild, fast and accountable, the Rabbit is the fourth animal within the 12-year cycle of the Chinese language horoscope. Along with yin water, this mix bodes effectively for a calmer 2023 in comparison with final yr’s tumultuous expertise,” the brokerage wrote, whereas additionally reminding buyers to hunt skilled recommendation earlier than making a call. “This yr’s bazi, or future chart, advises us to step out of our consolation zone however stay conscious of perils afoot. In spite of everything, a rabbit’s foot is fortunate for everybody however the fluffy woodland creature.”

Tiger years, of which 2022 was one, are marked by being aggressive and unpredictable – and everyone knows how this went.

Greatest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Loopring | LRC | +11.4% | Sensible Contract Platform |

| Terra | LUNA | +6.3% | Sensible Contract Platform |

| Dogecoin | DOGE | +4.3% | Foreign money |

Greatest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Solana | SOL | −0.3% | Sensible Contract Platform |

Insights

A Lido DAO Proposal Faces Criticism, Even Earlier than It is Formally Introduced. What’s Subsequent?

By Sam Reynolds

As Ethereum’s Shanghai fork, which will allow for the withdrawal of staked ether, attracts nearer, Lido DAO, the entity behind the liquid staking token stETH, is making ready a proposal to permit for withdrawals from stETH. Whereas the proposal hasn’t been previously put earlier than the DAO for voting, it has discovered a critic in Galaxy Digital – and its governance token has dropped 15% within the final week regardless of sturdy efficiency from ether.

On the floor, Lido DAO’s proposal for permitting withdrawals from stETH appears routine and follows what’s anticipated within the Shanghai hard fork. Customers will ship a withdrawal request to a wise contract known as “WithdrawalQueue,” which is able to reserve the quantity of ether required for redemption in addition to calculate the redemption charge, then withdrawals might be processed within the order that they’re obtained.

However Galaxy has lately highlighted some points with the proposal because it stands, that would lead to a couple worst-case eventualities.

Inside the Ethereum staking economic system, slashing is type of like a sanction in opposition to a validator that’s accused of breaking the principles. The validator is penalized and both kicked off the Ethereum community or briefly censured. You may consider it as OFAC-by-democracy.

Often slashing solely occurs when validators have interaction in dangerous technical habits akin to proposing a number of blocks, submitting contradictory votes to proposals, or going offline for an prolonged time frame. However as CoinDesk columnist Nic Carter highlighted in a current piece, there was a severe grassroots effort to slash validators like Coinbase that complied with sanctions to disclaim Twister Money transactions. This isn’t good for institutional adoption.

Galaxy notes that Lido might be the goal of a mass-slash occasion, knocking its validators off the community. If this occurs, Lido would enter “bunker mode”, the place issues are delayed as much as 36 days for Lido to recalculate the stETH redemption charge and assess harm to the community. Worse, Galaxy writes, there’s the choice for a complete halt of withdrawals beneath what Lido calls the “gate seal sensible contract.”

“There are edge case eventualities that change withdrawal dynamics on Lido and spotlight distinctive dangers related to staking by way of an middleman,” Galaxy writes, arguing that there are inherent dangers with utilizing an middleman staking service above and past the dangers that come from Ethereum.

The success of the whole protocol, says Galaxy, depends totally on the value efficiency of stETH and the continued availability of liquidity within the stETH:ETH buying and selling pair.

“Within the occasion that Lido validators are penalized or slashed, lowering the quantity of complete staked ETH within the protocol, customers might obtain much less ETH for his or her stETH than what they’d initially submitted,” Galaxy writes.

Then there’s additionally the chance of delays.

“The Lido Withdrawal Queue is a further queue that operates individually from the withdrawals queue and exit queue enforced by the Etheruem protocol,” Galaxy writes. “Subsequently, there could also be extra delays that customers are topic to when withdrawing their staked ETH as a result of procedures set by the staking middleman.”

To make certain, Galaxy isn’t making an attempt to discourage anybody from utilizing an middleman like Lido. On-chain knowledge reveals that utilizing an middleman is how the overwhelming majority of staking is completed: Lido, Coinbase, Kraken, and Binance management almost 50% of this market.

It’s simply that there’s a new layer of threat launched, and on this market, it is one thing of which buyers must be extra cognizant.

Essential occasions

9:00 a.m. HKT/SGT(1:00 UTC) Eurozone Core Harmonized Index of Shopper Costs (YoY/Jan)

12:15 p.m. HKT/SGT(4:15 UTC) United States ADP Employment Change (Jan)

6:00 p.m. HKT/SGT(10:00 UTC) United States Fed Curiosity Price Determination