It’s hump and bump day within the Cryptoverse. Bitcoin and the remainder of the crypto market have been fluctuating in a single day, as per, however on the entire have landed above the place we had been this time yesterday.

There are some hefty day by day gainers, too, together with the decentralised trade dYdX, the Sydney-founded, Web3 gaming-focused layer 2 scaling blockchain ImmutableX and Elon Musk fave, Dogecoin.

We’ll get to these shortly. However first, let’s faucet into what comparability website Finder.com’s panel of specialists are predicting this yr and past for main layer 1 smart-contract blockchain Ethereum.

Finder’s newest Ethereum predictions

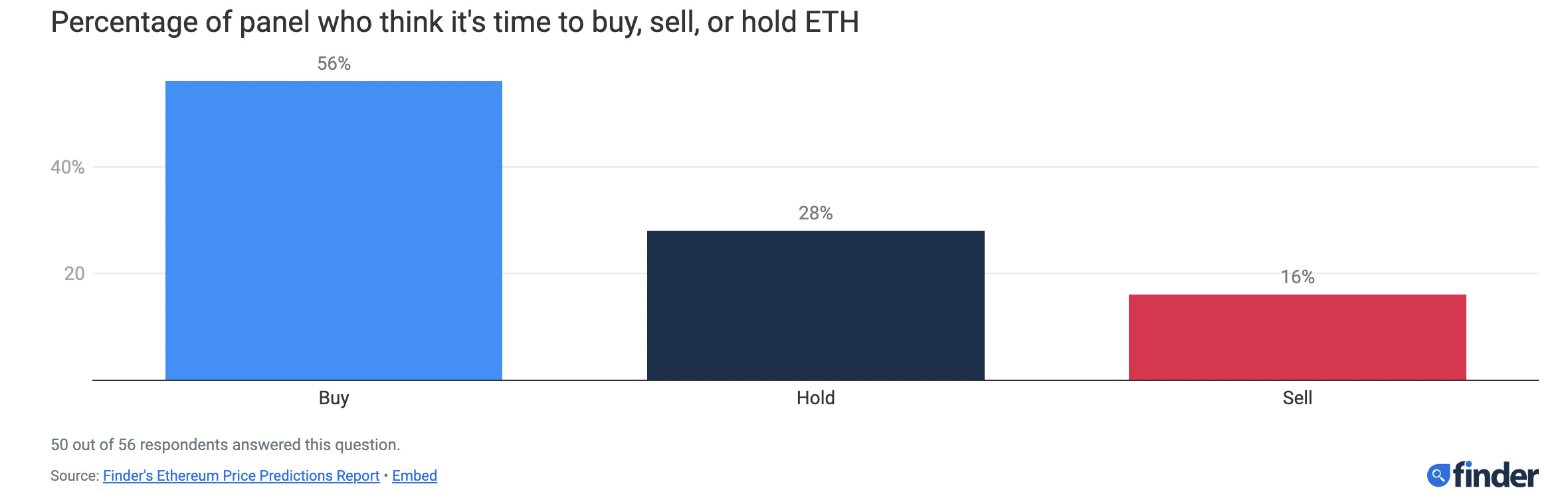

As ordinary, to type its panel, Finder has referred to as upon greater than 50 (56 to be exact) business specialists with various bullish and and bearish views.

Find the common throughout their predictions for the main altcoin, right here’s what was concluded:

The panel thinks Ethereum (ETH) will probably be value US$2,184 by the top of this yr, earlier than rising to $6,033 by 2025. It additionally thinks ETH will probably be value US$14,316 by 2030.

On the time of writing, ETH is altering palms for US$1,578.

Some extra nuanced, detailed takes from the panel:

• Ruadhan O, creator and founding father of Seasonal Tokens, is optimistic for ETH this yr and predicts a US$3k ETH this yr: “When financial exercise begins to select up, the transaction prices on the Ethereum community will rise,” he claimed. “This can power Ethereum customers to purchase extra ETH, offering extra upward stress on the value.”

• Ben Ritchie, managing director of Digital Capital Administration, thinks it may dip however is on monitor for the next degree come yr’s finish: “Latest market challenges have sparked investor concern and will restrict the value of Ethereum to achieve $2,500 this yr,” mentioned Ritchie. “Regardless of this, Ethereum’s low annual inflation charge is anticipated to maintain the value steady and above $900, even when future market disruptions happen.”

• John Hawkins, a lecturer on the College of Canberra, is in the meantime the panel’s Simon Cowell – its common über perma-bear – and thinks it’s time to promote ETH: “It was shocking how little affect lastly attaining the shift from PoW to PoS had on the Ether worth,” he mentioned. “This confirmed how little affect fundamentals have on crypto costs.”

Some 60% of the panel really feel that the crypto is under-priced, nonetheless, whereas 28% assume it’s bang on the cash the place it’s proper now. Solely 12% reckon it’s at present overpriced.

Moreover, virtually half of the Finder panel consider that Ethereum will ultimately flip Bitcoin to grow to be the most important crypto by market cap. And this ties in with the a number of the current thinking from institutional cryptos investors we’ve been listening to about currently.

Prime 10 overview

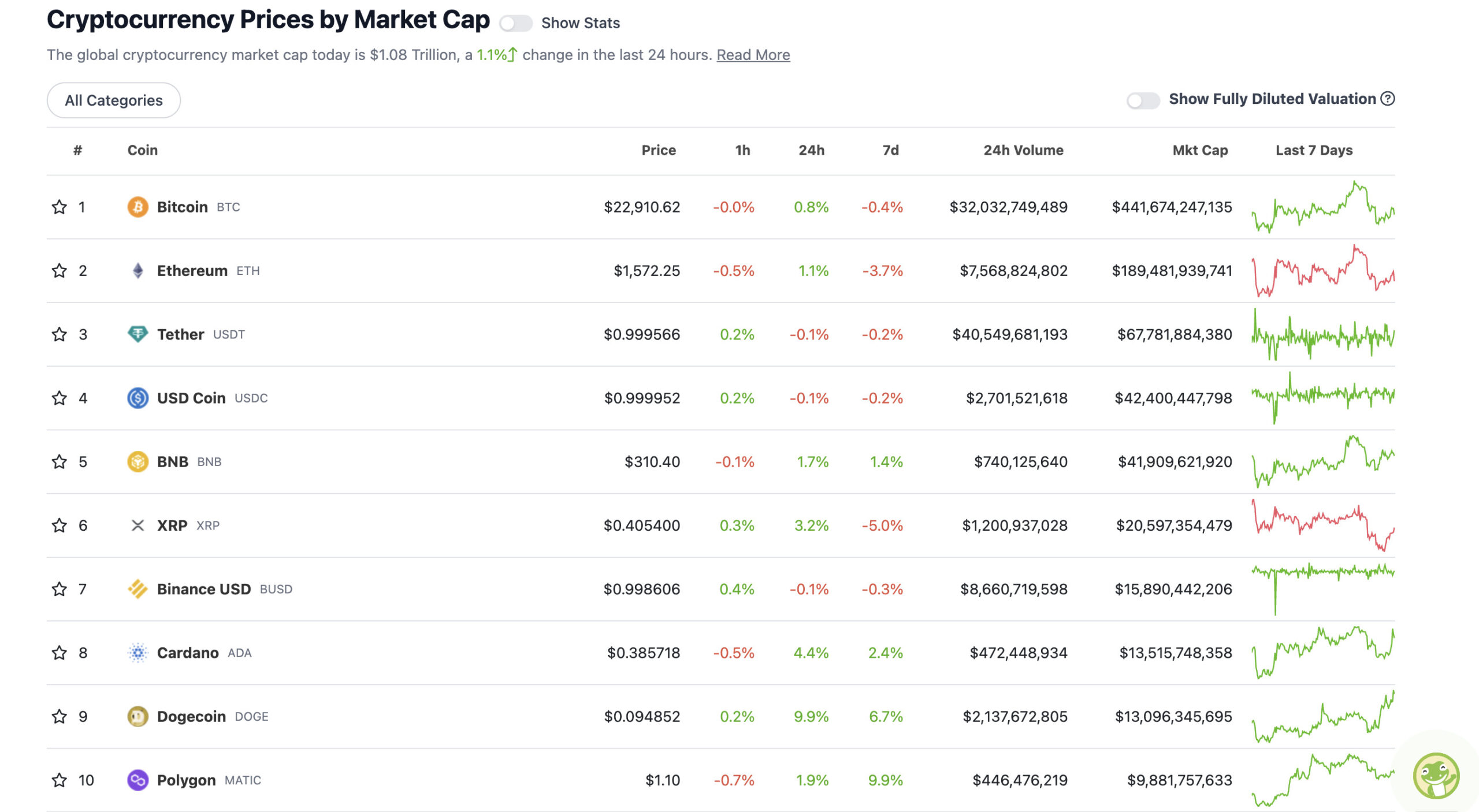

With the general crypto market cap at US$1.08 trillion, up about 1% since this time yesterday, right here’s the present state of play amongst high 10 tokens – in line with CoinGecko.

We’ve got to confess, after seeing Bitcoin do a 5% day by day dip yesterday, we’re a bit of stunned to see it maintain up so nicely. (Replace: it’s rising fairly rapidly as we sort, too.) Had thought for a second or two that pre-Fed-meeting jitters would possibly’ve despatched it a bit of decrease.

As an alternative, US inventory exchanges is likely to be displaying some confidence in a probably not-so-terrible Fed outlook come 6.30am Thursday (FOMC assembly time). A 25bps charge hike appears the most probably end result, however it’s Jerome Powell’s rhetoric/outlook which may matter greater than the determine. Gained’t even attempt to predict what he’s considering, so we’ll simply have to attend and see.

In the meantime, scanning the chart above, high meme token Dogecoin (DOGE) is the clear day by day winner with a close to double-digit pump.

Yesterday we started an article questioning why DOGE hadn’t spiked on the news that Twitter boss Elon Musk revealed intent to incorporate crypto in funds plans on the platform. Guess we had been simply “early” – because the “gm”-ing crypto crowd prefer to say.

Uppers and downers: 11–100

Sweeping a market-cap vary of about US$9.8 billion to about US$443 million in the remainder of the highest 100, let’s discover a number of the largest 24-hour gainers and losers at press time. (Stats correct at time of publishing, based mostly on CoinGecko.com information.)

DAILY PUMPERS

• dYdX (DYDX), (market cap: US$457 million) +23%

• Render (RNDR), (mc: US$429 million) +22%

• ImmutableX (IMX), (mc: US$581 million) +14%

• Fantom (FTM), (mc: US$1.36 billion) +14%

• Mina Protocol (MINA), (mc: US$688 million) +11%

Decentralized derivatives trade dYdX has been surging on the information the protocol has delayed the unlock of its DYDX token for traders till the fourth quarter this yr. The trade introduced it in a blog post in a single day (AEDT).

Render, in the meantime, which is a metaverse-related venture that provides distributed rendering providers for 3D fashions and environments, is up significantly as nicely. Wanting a full “deep dive” into this one, we’re struggling to see why. We’ll come again to it right here and replace if we discover related information.

As for ImmutableX, it’s an absolute partnership beast simply currently. Certainly one of its co-founders, Alex Connolly, lined off a lot of its latest developments with us in a broad-ranging chat late final week. However right here’s some recent information that is likely to be inflicting its 24-hour spike.

It has a brand new product launch referred to as Passport, which is basically designed to be a easy and safe onboarding resolution for sport studios. Ever Since Immutable’s partnership with GameStop, it’s been doing loads of mentioned game-related onboarding.

Introducing Immutable Passport, your passport to the way forward for gaming 🎮

We’re creating Immutable Passport, the moment non-custodial pockets onboarding resolution for web3 video games. Designed to onboard the subsequent billion customers into web3 #onIMXhttps://t.co/A8WKmGUxlV pic.twitter.com/NOxmZl2vDk

— Immutable 🅧 – $IMX (@Immutable) January 31, 2023

DAILY SLUMPERS

• BTSE Token (BTSE), (market cap: US$478 million) -3%

• Convex Finance (CVX), (market cap: US$423 million) -2%

• LEO Token (LEO), (mc: US$3.3 billion) -2%

• Aptos (APT), (mc: US$2.7 billion) -1%

Across the blocks: German banking big eyes crypto choices

Some pertinence and randomness that caught with us on our morning strikes by means of the Crypto Twitterverse.

There was some first rate crypto-adoption information out of Germany in a single day. As CoinDesk reviews:

“DekaBank, a German lender with 360 billion euros (US$390 billion) in property below administration, joins Societe Generale and Citibank in deciding on Switzerland’s Metaco to develop its digital asset choices for institutional purchasers, in line with a press launch.”

BREAKING‼️ | 🇩🇪 German banking big DekaBank to supply #Bitcoin and crypto to 1.5m retail prospects and +500 institutional purchasers.

DekaBank manages $428 Billion in property! pic.twitter.com/8Xd49hn682

— SHIB Bezos (@BezosCrypto) January 31, 2023

#Bitcoin Pumping 🚨 Brief Time period

Attention-grabbing worth motion.

Are the bulls getting positioned for a serious FED pump?!

— Kevin Svenson (@KevinSvenson_) January 31, 2023

BREAKING: Lebanon will devalue its native fiat forex by 90% in a single day.

🇱🇧 wants #Bitcoin pic.twitter.com/WVrC02fTMC

— Bitcoin Journal (@BitcoinMagazine) January 31, 2023