Being organized is among the keys to successful on the video games we play, however I’ve to confess that I’d gotten lazy. When my spouse and I lately counted up the variety of currently-open bank cards we’ve got, I used to be a bit stunned by the reply. We had fifty-three open playing cards. The cumulative in annual charges is staggering (although needless to say in some circumstances it’s simpler for somebody like me to justify retaining a card given the truth that I write about bank cards and their advantages for a residing). Nonetheless, I wanted to create a plan of assault to cut back each the stress of monitoring so many playing cards and the quantity we’re paying in annual charges. The Platinum playing cards have been a pure first goal given their excessive annual charges.

Getting organized

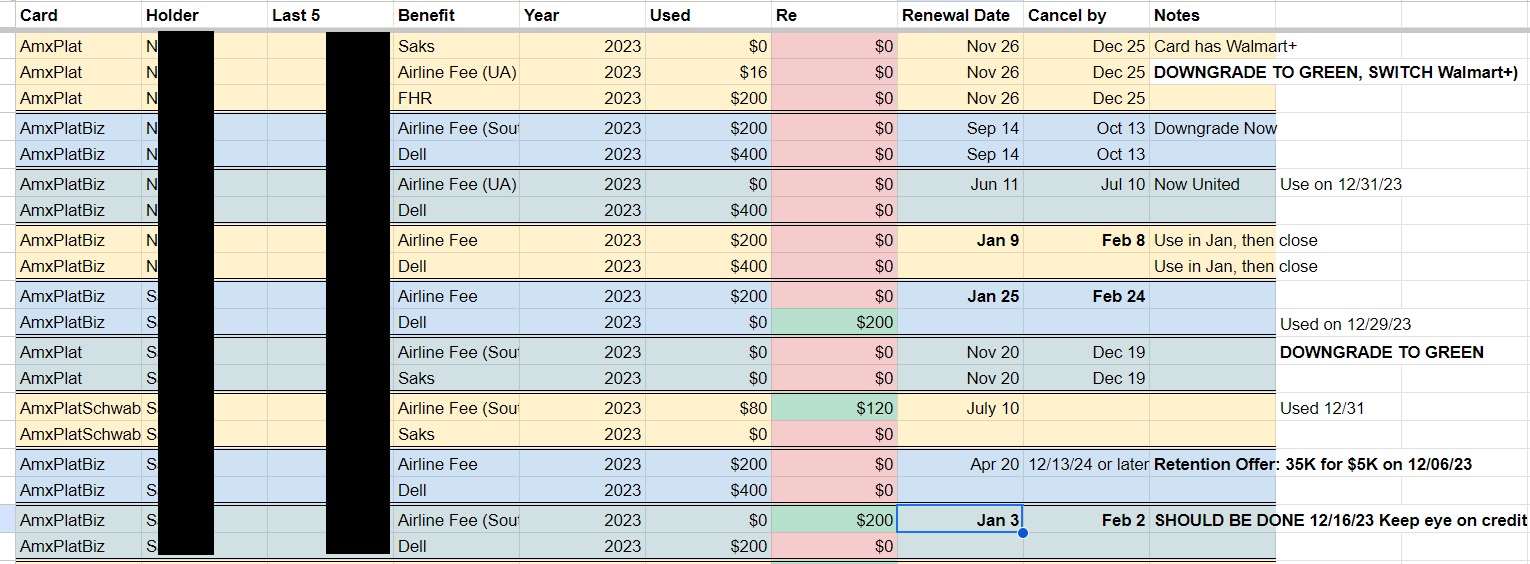

The very first thing I did final month to cut back a few of my psychological stress was create a spreadsheet to trace numerous “spoiling stock” within the sense of annual credit, month-to-month credit, annual free night time certificates, and different comparable issues throughout our playing cards. I created one tab only for Platinum playing cards that features which of us holds the cardboard, the previous couple of digits of the cardboard quantity, the important thing assertion credit score advantages and the way a lot we’ve got used / how a lot is remaining on every.

The sheet additionally has tabs for our Enterprise Gold playing cards for his or her $20 month-to-month credit and for our free night time certificates. I additionally created a tab for card-linked gives we must always use the place I’ll monitor Amex Provides that we must always use or have used and that form of factor.

That each one helped make issues visible and it has lowered the potential for errors in utilizing, downgrading, or canceling the flawed card since I can see which credit are related to which card, which airline has been chosen (I’ll most likely break airline choice out into its personal column), and many others. I added a column for notes on the finish the place I may write reminders like the truth that I want to alter our Walmart+ cost methodology earlier than I do away with the Platinum card at present related to that cost.

Simply earlier than the tip, there’s a column with the date that the final annual charge was charged and a “cancel by” column to notice the day a couple of month later that may be the approximate cancellation deadline (I didn’t determine these fairly precisely at 30 days). My long-term plan is to get this whole sheet added to our regular month-to-month expense / budget-tracking spreadsheet, however I began it individually and haven’t but perfected it. Nonetheless, it was instrumental in getting my stuff collectively. I’ll be the primary to confess that I’m not a very good spreadsheet-maker, however I’ll additionally readily let you know that working for Frequent Miler has helped me understand simply how helpful a spreadsheet could be.

I ought to add that Platinum playing cards have further advantages just like the Uber credit and digital leisure credit that aren’t proven right here. That’s as a result of I find yourself utilizing all of our Uber credit on a single dinner order as soon as a month, so I don’t want particular person monitoring for these, and I don’t at present use the digital leisure credit (my mistake on forgetting to alter my Disney+ membership to month-to-month earlier than it renewed on the annual price!). I simply don’t use the remainder of the qualifying providers in any respect.

Our Amex client Platinum card plan of assault

My spouse and I at present have 3 client Platinum playing cards and 6 Enterprise Platinum playing cards between us. That’s far an excessive amount of Platinum at a $695 annual charge for every.

We have now a Schwab Platinum card, which we preserve for occasions after we determine to money out factors on condition that you can redeem points for a deposit to your brokerage account at a value of 1.1c per point. We additionally every have a daily “vanilla” Platinum card that we opened underneath unbelievable welcome gives throughout the pandemic (you could recall that I bought a car and earned over half a million points). We saved these client Platinum playing cards as a result of Amex has targeted subsequent new cardmember referral offers to some customers and we’ve got every had a flip or two the place one in every of these playing cards has referred to the most effective out there Platinum card supply, so we’ve every maxed out our referral factors on these playing cards for the previous couple of years.

We’ve made respectable use of the advantages on these playing cards: we had no bother utilizing our Fantastic Motels & Resorts / The Lodge Assortment advantages (final 12 months, we ended up utilizing these during our extended stay in Las Vegas and we used credit from the earlier 12 months for a keep in Brussels, Belgium over the summer time). We used our Uber credit for Uber Eats in each month however one and we used our airline incidental credit between United and Southwest as outlined in our put up about Amex airline fee reimbursements: What still works?. Whereas I wouldn’t worth these advantages at face worth, when mixed with the referral factors earned from every card, the maths has made them value retaining.

No less than, that was true till I checked out a spreadsheet with 53 lively bank cards, 9 of that are Platinum playing cards. The calculus has modified on that as we haven’t had referral gives in any respect on our client Platinum playing cards lately and I do know that we’ll nonetheless probably have alternatives to select up some referral factors with different playing cards. I made a decision that we every have to drop a client Platinum card.

The 30-day window missed: downgrading for a pro-rated annual charge

My spouse and I every had a client Platinum card that renewed in late November. We had till late final month to cancel with out having to pay the annual charge. Sadly, I left our airline incidental credit till late within the 12 months to make use of up. As destiny would have it, the credit posted someday after the 30-day mark from the date the annual charge charged, so we couldn’t keep away from paying the brand new annual charges completely. If we canceled these playing cards greater than 30 days from the date the annual charge posted, we wouldn’t get something again — we’d have simply lit $695 on fireplace (occasions two!).

Nevertheless, the truth that the credit have been sluggish in posting is just a small bummer because the airline incidental charge credit and Fantastic Motels & Resorts / Lodge Assortment credit are calendar 12 months advantages. By holding these playing cards an additional couple of weeks past after we meant to cancel them, we’ll get an opportunity to every use our $200 Fantastic Motels & Resorts credit score for 2024 and our $200 airline incidentals profit for 2024. I haven’t but seen one thing that strikes my fancy at Saks Fifth Avenue, however we’ve got a visit arising this month that can put us within the neighborhood of a Saks retailer, so we’ll most likely every purchase a $50 present card in-store to make use of the January-to-June Saks profit. To be clear, that credit score isn’t presupposed to work for present playing cards, however in apply present card purchases made in-store have credited like some other buy.

As soon as the credit for all of these purchases put up, we’ll every downgrade to a client Inexperienced card. As a result of we’re past the 30-day window because the annual charge was charged, Amex will now not refund the annual charge in full. Nevertheless, they’ll pro-rate the annual charge if we downgrade. Due to this fact, we’ll each look to downgrade to a client Amex Inexperienced card. Once we do, I anticipate that we’ll every get refunded about $580 after which get charged about $125 for the prorated Inexperienced card annual charge (I’m assuming that we’ll get charged for two months of Platinum card membership and 10 months of Inexperienced card membership).

A necessity for Inexperienced earlier than we downgrade

Neither of us have ever had the patron Inexperienced card. That presents an additional wrinkle: Amex software phrases point out that you may not get the welcome bonus on a card that you’ve got or have had beforehand. Due to this fact, if we downgrade our Platinum playing cards to Inexperienced playing cards, we is not going to be eligible for welcome bonuses on the Inexperienced playing cards sooner or later.

Whereas neither of us are excited concerning the present Inexperienced card welcome supply on the time of writing, we every have at the very least one present Amex card providing 20,000 Membership Rewards factors per referral. Needless to say Amex permits cross-referrals, so if my Enterprise Gold card reveals a bonus of 20,000 Membership Rewards factors when a good friend is authorized, I can create a referral hyperlink from my Enterprise Gold card to refer my spouse to a client Inexperienced card. See extra particulars and a video explaining this in additional element on this put up: How to create cross-brand Amex referrals.

That signifies that if I refer my spouse, she’ll get the present Inexperienced card welcome supply and I’ll get 20,000 factors when she is authorized. The identical is true the opposite manner — she will be able to refer me and earn 20,000 factors on high of the welcome supply that I earn. Between the 2 of us, that’s like a bonus third welcome supply for each opening the Inexperienced card with one another’s referral hyperlinks. Whereas Amex family language prevents those who have or have had a Platinum card from getting a Gold card, there isn’t any such household language on the Inexperienced card on the time of writing.

Once more, the present welcome supply on the Inexperienced card is low. I want we may look forward to a greater welcome supply (or that we had jumped on a greater supply over the past couple of years!). Nevertheless, on condition that we every wish to downgrade a Platinum card imminently, the time is now for us every to get a Inexperienced card with a welcome bonus. Possibly I’ll give it a number of extra days or per week simply in case the supply adjustments, however I’ve obtained no motive to anticipate that it’s going to within the near-term.

That signifies that we’ll find yourself paying both a prorated or new annual charge on 4 Inexperienced playing cards between the 2 of us, however we’ll nonetheless spend at the very least $700 lower than we’d have if we saved the Platinum playing cards. And by every opening the Inexperienced card for a welcome bonus earlier than downgrading a Platinum card, we’ll find yourself with 120,000 factors between welcome gives and referral factors. We’ll additionally set off $400 in airline incidental credit, $400 in Fantastic Motels & Resorts credit, and we’ll “financial institution” $100 in Saks credit between the 2 of us with our Platinum playing cards earlier than downgrading. I think about we’ll additionally every use our $15 Uber credit this month by way of Uber Eats. After a 12 months has handed, we’ll probably each intend to cancel the Inexperienced playing cards we obtained by downgrading Platinum playing cards and we’ll probably search for a retention supply on our new Inexperienced playing cards to make them value retaining.

That may handle two client Platinum playing cards. We’ll preserve the Schwab Platinum. However what about all these Enterprise Platinum playing cards?

Amex Enterprise Platinum plan

On the Enterprise Platinum aspect, we every have three Enterprise Platinum playing cards that we’ve gotten because of Amex’s repeated focused “broaden your membership” gives to open new Enterprise Platinum playing cards with out lifetime language. I like the concept of every of us retaining a Enterprise Platinum card because of the 35% Pay-with-points rebate. Whereas we haven’t used that extensively, we’ve used it at the very least every year every of the previous a number of years (most lately simply final week to guide flights on Spirit Airways after our vacation plans went haywire). Nonetheless, we don’t want the six playing cards we at present have. Whereas some will discover it helpful to have multiple Enterprise Platinum with a purpose to set them up with completely different airways for the rebate on economic system class flights, I’ve had no bother altering my airline even after having partially used the airline charge credit score, so I’ll simply plan to carry one card every for the rebate.

Every of us has one Enterprise Platinum card set to resume inside the subsequent few days, so these shall be straightforward to deal with. We’ll look to every use our $200 in airline incidental advantages and the $200 Dell credit score for January-June inside the subsequent week after which we’ll cancel these playing cards earlier than the annual charge comes due subsequent month (inside 30 days of the date the charge is charged). That may drop us to 4 Enterprise Platinum playing cards (which continues to be too many!).

We have now one other Enterprise Platinum card the place the annual charge will come due late subsequent month. We’ll probably additionally look to make use of the advantages on that card yet another time after which cancel it outright as quickly because the annual charge is charged. After which there have been three . . .

Final month, my spouse tried to cancel one in every of her Enterprise Platinum playing cards. That card had renewed all the way in which again in April. Whereas it wouldn’t have made a ton of sense to cancel proper earlier than calendar-year credit renewed in January, we have been seeking to make progress towards the purpose of fewer playing cards and had determined to sacrifice the shot at yet another spherical of credit in favor of getting one card off the chopping block. She chatted with assist to cancel and to my shock, she was given a retention supply of 35,000 factors with $5,000 in purchases. That’s successfully 7 further factors per greenback over the 1 level per greenback that the cardboard ordinarily earns on most purchases. In case you assume that we’d have ordinarily earned at the very least 2 factors per greenback on that $5K in purchases if we had put the purchases on a special card, you could possibly account for it actually feeling like an extra 6 factors per greenback spent. That was sufficient to make it value retaining that Enterprise Platinum card since we’ve got sufficient in strange bills to fulfill the spend with out sacrificing the rest. That leaves us with two extra Enterprise Platinum playing cards to cope with.

Our final two Enterprise Platinum playing cards are set to resume later within the 12 months — one in June and the opposite in September. I’d prefer to preserve one open for future 35% rebates, however I don’t want each playing cards. Due to this fact, I intend to make use of the airline charge credit and Dell credit straight away on the cardboard set to resume in September after which I’ll downgrade that card to a Enterprise Inexperienced card as quickly as attainable, meaning to cancel it when it comes up for renewal subsequent September. The explanation I’ll look to downgrade that card forward of the opposite one is as a result of it has been used for 3 fewer months, so I anticipate to get an extra ~$175 again once I downgrade that card over what I might get for the cardboard set to resume in June.

Right here’s what I imply:

- The cardboard with a June anniversary date is now 7 months into the cardmember 12 months. If I downgraded immediately, I might anticipate to get a prorated refund for five months of the $695 annual charge (5/12 of $695 is about $289).

- The cardboard with a September anniversary date is now 4 months into the cardmember 12 months. If I downgraded immediately, I might anticipate to get a prorated refund for 8 months of the $695 annual charge (8/12 of $695 is $396.67).

In brief, I’ll get an extra $100+ again if I downgrade the cardboard with the later anniversary date. I’m nonetheless not getting a outstanding deal since I’ve already way back paid the annual charges, however I’d slightly get an additional hundred bucks again than not get it again.

I received’t search for a retention supply proper now on whichever card I shut as a result of that may lock me into retaining the cardboard for one more 13 months — which means that I’d be caught in one other mid-year downgrade/cancel disaster 13 months from now. I’d slightly simply clear up the mess.

The factors parade has been lots of enjoyable, however now it’s getting costly and I have to make it possible for I get off the hamster wheel earlier than it takes me for a experience.

Backside line

After finishing up the plans laid above, we’ll every have one Enterprise Platinum card and my spouse can even have a Schwab Platinum card – lowering our Platinum portfolio from 9 Platinum playing cards to three. That’s a fairly vital financial savings that makes a pleasant dent in our cumulative annual charge outlay. I nonetheless have loads of work to do to skinny the herd of bank cards in our secure earlier than the charges skinny our financial savings greater than we’d like, however these Platinum plans are vital to deal with sooner slightly than later in order that we will benefit from calendar 12 months advantages with out stretching the downgrade and cancellation course of farther than vital since time undoubtedly equals cash in charges we’ll be charged or lose. Sooner or later, I hope that my new spreadsheet will preserve me a bit extra organized in order that I’m not scrambling with 30-day deadlines on the finish of a cancellation window and we will make sure to keep away from letting any advantages go unused. Once more, group is a significant key to successful the video games we play.

Need to study extra about miles and factors? Subscribe to email updates or take a look at our podcast in your favourite podcast platform.