Disclaimer: The datasets shared within the following article have been compiled from a set of on-line sources and don’t mirror AMBCrypto’s personal analysis on the topic

XRP is a cryptocurrency that was developed by Ripple Labs, an organization that gives monetary settlement and fee providers to banks and different monetary establishments. XRP is utilized by Ripple Labs as a way of facilitating cross-border funds and has gained vital adoption within the monetary trade.

One purpose for XRP’s comparatively robust efficiency could also be its robust adoption within the monetary trade. Many banks and monetary establishments have begun utilizing XRP as a way of facilitating cross-border funds, which has helped to extend demand for the cryptocurrency. Moreover, Ripple Labs has made vital efforts to advertise the adoption of XRP, which has helped to extend its credibility and attraction.

Within the early years of XRP, its value was comparatively secure, with some durations of development and others of stagnation. Nevertheless, prior to now 12 months or so, the value of XRP has seen some vital fluctuations. In late 2020, XRP’s value skilled a major bull run, reaching an all-time excessive of over $3 in December of that 12 months. This was pushed partially by the general bull market within the cryptocurrency house, in addition to robust demand for XRP as a utility token within the monetary trade.

Ripple was within the information earlier this week after its collaboration with Palau got here to gentle. In keeping with President Surangel Whipps Jr, the nation will launch a stablecoin in collaboration with Ripple.

Learn Price Prediction for XRP for 2023-24

Regardless of some fluctuations in value, XRP has confirmed to be a well-liked alternative for a lot of buyers and merchants, and its adoption and use by monetary establishments have continued to develop over time.

A report by CoinShares indicated that buyers are assured of Ripple’s victory on this landmark case. That is primarily based on the truth that XRP funding merchandise have seen constant inflows for 3 consecutive weeks.

In different information, Ripple CTO David Schwartz took to twitter to supply former staff of the troubled crypto trade FTX, a spot at Ripple. Nevertheless, this provide solely stands for workers who weren’t concerned with compliance, finance, or enterprise ethics.

On the enterprise entrance, Ripple revealed key developments pertaining to its European enlargement. The corporate shared its progress with Paris- primarily based Lemonway and Xbaht in Sweden. Companies in France and Sweden will now be capable to leverage Ripple’s On-Demand Liquidity (ODL).

On 15 November, Ripple announced that it partnered with MFS Africa, a number one fintech agency with the most important cell cash footprint within the continent. This three way partnership seeks to streamline cell funds for customers in 35 nations.

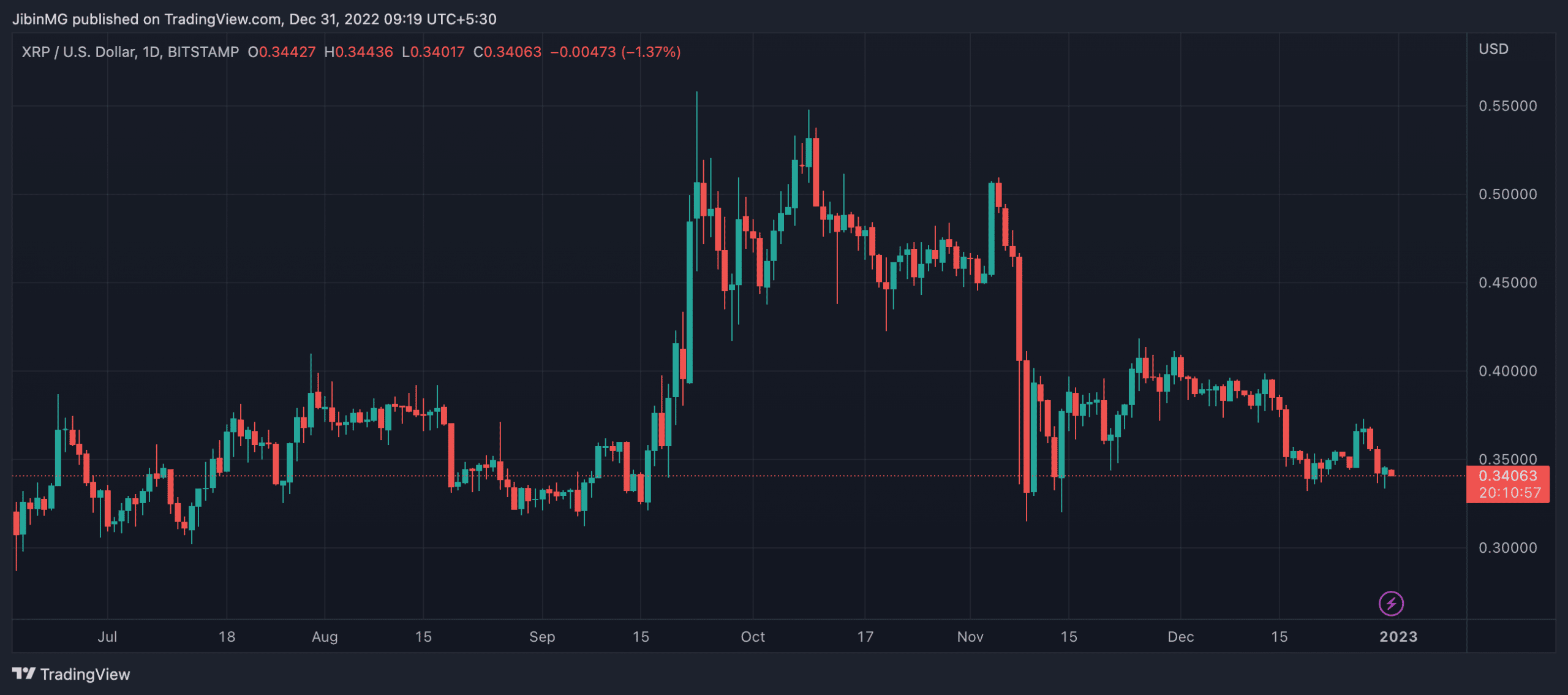

XRP, at press time, was buying and selling at $0.34, down 4% over the past 7 days. Its press time market capitalization stood at $17.11 billion, with a 24-hour buying and selling quantity of $404 million.

In regards to the platform

Ripple’s tie-up with Tokyo Mitsubishi Financial institution in 2017 was a significant milestone. Following the identical, it grew to become the second-largest crypto by market capitalization for a short interval. A 12 months later, Ripple was within the information once more for its partnership with worldwide banking conglomerate Santander Group for an app specializing in cross-border transactions.

By way of rivals, Ripple has near none in the mean time. They’re the main crypto agency catering to monetary establishments world wide. Because the variety of partnerships grows, by extension, XRP will reap the advantages. In any case, it’s the medium of trade for all cross-border transactions enabled by RippleNet.

Ripple has been capitalizing on the necessity for fast transactions and one other untapped potential in rising economies, on condition that nations in Latin America and Asia Pacific areas usually tend to notice the worth of blockchain and its tokens in comparison with their first-world counterparts. With the rise of central financial institution digital currencies (CBDC), it’s probably that creating nations seeking to discover this selection will go for Ripple because it already provides a well-established cross-border framework. Elevated adoption of CBDCs can even result in banking establishments contemplating integrating crypto into their providers. This can work out very nicely for Ripple because it RippleNet is already related to a variety of banks.

Blockchain options being provided to Ripple’s Central Financial institution companions eager to enterprise into CBDCs embody the choice to leverage the XRP ledger utilizing a non-public sidechain.

Ripple is predicted to develop quickly over the forecast interval, as it may be used for quite a lot of capabilities like accounting, funding, good contract implementation, and decentralized programming.

XRP has an edge over its rivals resulting from its low price of entry. The truth that just a few {dollars} will purchase tens of XRP appears interesting to new buyers, particularly those that choose little funding.

In keeping with a Valuates report, the cryptocurrency market’s dimension is predicted to hit $4.94 billion by 2030, rising at a CAGR of 12.8%. Plenty of crypto-firms will profit from this, Ripple amongst them.

The expansion within the cryptocurrency market is spurred by a rise within the demand for operational effectivity and transparency in monetary fee programs, in addition to a rise in demand for remittances in creating nations.

The overall thought is that RippleNet’s adoption by monetary establishments will improve, resulting in extra recognition of the platform in addition to its native token. This has additionally been factored in whereas calculating predictions for 2025 and past.

At press time, XRP was buying and selling at $0.340.

XRP’s press time value was a far cry from its all-time excessive of $3.84 in January 2018. As a matter of reality, its value was nearer to its launch value than it’s to its all-time excessive.

Though XRP did achieve considerably over the past 30 days, its year-to-date returns have buyers fearful.

SEC lawsuit and its influence

On 22 December 2020, the U.S Securities and Alternate Fee (SEC) filed a lawsuit in opposition to Ripple Labs. The lawsuit alleged that Ripple had raised $1.3 billion by means of the sale of ‘unregistered securities’ (XRP). Along with this, the SEC additionally introduced expenses in opposition to Ripple’s high executives, Christian Larsen (Co-founder) and Brad Garlinghouse (CEO), citing that they’d made private features totaling $600 million within the course of.

The SEC argued that XRP must be thought-about safety relatively than a cryptocurrency and as such, must be beneath their purview.

A verdict in favor of the SEC will set a relatively disagreeable authorized precedent for the broader crypto market. This is the reason this case is being carefully noticed by stakeholders within the trade.

It’s evident that developments within the lawsuit have a direct influence on XRP’s value. Following the information of the lawsuit in 2020, XRP tanked by virtually 25%. In April 2021, the decide handed Ripple a small victory by granting them entry to SEC’s inner paperwork, which prompted XRP to rise over the $1-mark – A threshold that the crypto hadn’t crossed in 3 years.

In keeping with a tweet by Protection Lawyer James Filan on 15 August 2022, the U.S District Courtroom for the Southern District of New York dealt one more blow to the SEC when Choose Sarah Netburn granted Ripple’s movement to serve subpoenas to acquire a set of video recordings for the aim of authentication, dismissing the regulators declare that Ripple was making an attempt to reopen discovery. This was in response to Ripple’s motion filed on 3 August 2022.

Within the Opinion & Order printed earlier in July, Choose Sarah Netburn condemned the SEC for its “hypocrisy” and actions which recommended that the regulator was “adopting its litigation positions to additional its desired purpose, and never out of a devoted allegiance to the regulation.”

The lawsuit’s verdict, no matter it’s, could have an enduring influence on XRP’s worth. You will need to word {that a} verdict in favor of the SEC would make XRP safety solely within the U.S as a result of the regulator doesn’t have jurisdiction throughout the nation’s borders. This could offset a number of the harm to Ripple, on condition that it has a considerable quantity of enterprise globally

Carol Alexander, Professor of Finance on the College of Sussex, believes that XRP is in contrast to every other crypto. She believes that if Ripple manages to beat the SEC lawsuit, it might begin taking up the SWIFT banking system. SWIFT is a messaging community that monetary establishments use to securely transmit info and directions

In an interview with CNBC, Ripple CEO Brad Garlinghouse talked about the opportunity of an IPO after the case with the SEC is resolved. Ripple going public could have a major influence on XRP’s value motion within the following years.

In an interview with Axios at Collision 2022, Garlinghouse additional acknowledged that the present value of XRP has already factored in Ripple shedding the case. “If Ripple loses the case, does something change? It’s principally simply establishment” he added.

As for his private opinion on the decision, Garlinghouse is betting that it will likely be in favor of Ripple. “I’m betting that as a result of I feel the info are on our aspect. I’m betting that as a result of the regulation is on our aspect,” he remarked.

Curiously, help for Ripple and XRP hasn’t been common actually, with Ethereum’s Vitalik Buterin just lately commenting,

“XRP already misplaced their proper to safety after they tried to throw us beneath the bus as “China-controlled” imo”

In courtroom and in papers

Ripple and the SEC’s lawsuit isn’t just restricted to the courtroom. The matter is commonly lined by the media with each events having been featured in a number of op-eds, usually criticizing one another. Simply this month, the market watchdog and the crypto agency have been the topic of a heated trade by means of items printed by the Wall Road Journal.

On August 10, SEC Chairman Gary Gensler reiterated his stance on the definition of crypto belongings and their oversight in his op-ed piece featured in The Wall Road Journal. “Make no mistake: If a lending platform is providing securities, it . . . falls into SEC jurisdiction.”

Chairman Gensler went on to quote the $100 million settlement that the regulator had reached with BlockFi, stating that the crypto markets should adjust to “time-tested” securities legal guidelines. As per the phrases of the settlement, BlockFi has to rearrange its enterprise to adjust to the U.S Funding Firm Act of 1940 along with registering beneath the Securities Act of 1933 to promote its merchandise.

In response to Chairman Gensler’s op-ed, Stu Alderoty published his personal piece in The Wall Road Journal and didn’t mince his phrases whereas taking a shot on the regulator. Alderoty accused Gensler of side-lining fellow regulators (CFTC, FDIC and many others.) and overreaching its jurisdiction, versus the chief order by U.S President Joe Biden, which directed companies to coordinate on rules for crypto.

“What we’d like is regulatory readability for crypto, not the SEC swinging its billy membership to guard its turf on the expense of the greater than 40 million People within the crypto financial system,” Alderoty added.

A controversial article authored by Roslyn Layton in Forbes on 28 August identified that since 2017, the SEC’s Crypto Property Unit has been concerned in 200-odd lawsuits. In keeping with Layton, this determine means that as a substitute of developing with clear rules to make sure compliance, the regulator would relatively interact crypto corporations with lawsuits in an try to control by enforcement.

Ripple CTO David Schwartz discovered himself in a stand-off with Ethereum Co-Founder Vitalik Buterin earlier this month, after Buterin took a dig at XRP on twitter. Schwartz hit again and responded to Buterin’s tweet, evaluating miners within the PoW ecosystems like Ethereum to stockholders of corporations like eBay.

“I do suppose it’s completely truthful to analogise miners in PoW programs to stockholders in corporations. Simply as eBay’s stockholders earn from the residual friction between patrons and sellers that eBay doesn’t take away, so do miners in ETH and BTC,” Schwartz added.

Now, placing an correct determine on the longer term value of XRP is just not a straightforward job. Nevertheless, so long as there are cryptocurrencies, there will probably be crypto pundits providing their two cents on market actions.

Ripple [XRP] Worth Prediction 2025

Changelly has gathered a median prediction of $0.47 for XRP by the tip of 2022. As for 2025, Changelly has offered a spread between $1.47 to $1.76 at max for XRP.

Finder’s conclusion from a panel of thirty-six trade specialists, is that XRP must be at $3.61 by 2025. It must be famous that not all of these specialists agree with that forecast. A few of them consider that the crypto gained’t even cross the $1 threshold by 2025. Keegan Francis, the worldwide cryptocurrency editor for Finder, doesn’t agree with the panel of specialists. He predicts that XRP will probably be value $0.50 by the tip of 2025 and surprisingly, a mere $0.10 in 2030.

In keeping with information printed on Nasdaq, the typical projection for 2025 is round $3.66.

Are your XRP holdings flashing inexperienced? Test the profit calculator

Ripple [XRP] Worth Prediction 2030

Finder’s specialists had a relatively conservative determine for XRP in 2030. They consider that the crypto might hit $4.98 by 2030. In an announcement to Finder, Matthew Harry, the Head of Funds at DigitalX Asset Administration, revealed that he doesn’t see any utility in XRP apart from the hypothesis factor.

In keeping with information printed on Nasdaq’s website, the typical projection for 2030 is round $18.39.

Conclusion

12 months-to-date (YTD) figures from Ripple’s Quarter 2 earnings report have made it clear that regardless of the drop in XRP’s value, demand for his or her On-Demand Liquidity service not solely remained undeterred however truly grew by 9 occasions year-over-year (YoY) with ODL gross sales totalling $2.1 billion in Q2. The report additional acknowledged that Ripple has pledged $100 million for carbon elimination actions, according to their carbon impartial goal and sustainability objectives.

Ripple’s Crypto Traits report claims that NFTs and CBDCs are nonetheless of their nascent levels and as their potential is steadily realized, its influence on Ripple’s community and on the broader blockchain house will probably be seen.

It must be famous that whereas varied specialists have predicted XRP’s value to extend within the following years, there are some who consider that XRP will lose all worth by the tip of the last decade.

The foremost elements that may affect XRP’s value within the coming years are,

- Verdict of the SEC lawsuit

- IPO after lawsuit is resolved

- Partnerships with Monetary Establishments

- Mass Adoption

- CBDC ventures by Central Banks

Predictions should not resistant to altering circumstances and they’ll all the time be up to date with new developments.

With the Concern and Greed index nonetheless struggling to get better, uncertainty is sure to be related to XRP and the remainder of the crypto-market at this second.