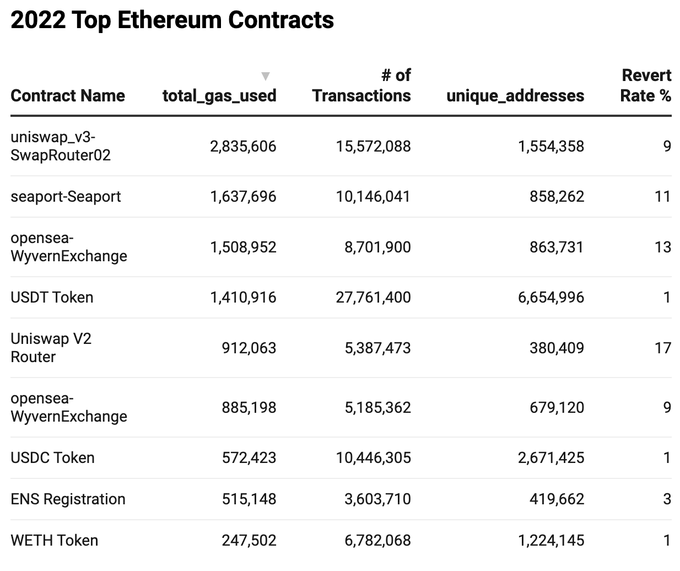

Uniswap V3 has develop into the most well-liked Ethereum contract in 2022, rating first in relation to complete fuel used all year long.

In response to knowledge from Dune Analytics, Uniswap V3 used up over 2.8 million fuel in 2022. That is greater than 3 times greater than the quantity of fuel consumed in Uniswap V2, exhibiting that customers have flocked en masse to the DEX’s latest iteration.

Uniswap V2 additionally noticed 17% of its transactions reverted, the very best share out of all the hottest Ethereum contracts.

The decentralized trade additionally noticed a complete of 15.5 million transactions this 12 months, surpassing OpeanSea’s Seaport NFT market and OpenSea itself. With over 1.5 million distinctive addresses, Uniswap V3 additionally ranks greater than some other Ethereum dApp.

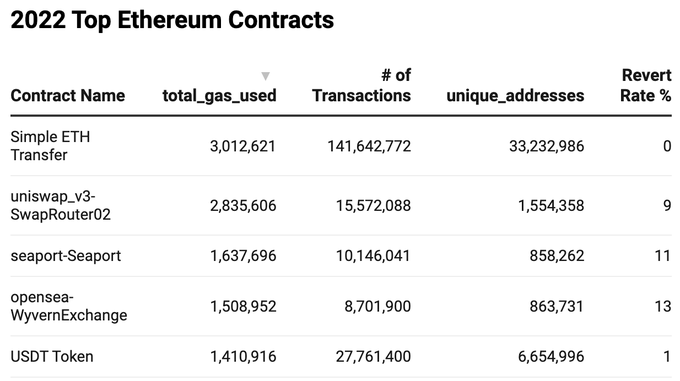

Solely easy Ethereum transfers used up extra fuel than V3 this 12 months, with over 3 million fuel spent on over 141.6 million transactions. Tether’s USDT noticed 27.7 million transactions this 12 months and used up 1.4 million fuel, whereas Circle’s USDC used up 572,000 fuel for 10.4 million transactions.

Hayden Adams, the founding father of Uniswap Labs, the corporate behind the favored DEX, celebrated Uniswap’s success:

“Cool to see Uniswap V3 was essentially the most used contract on Ethereum by a large margin for 2022.”

Adams famous that V2 of the decentralized trade was nonetheless among the many high 5 most used contracts on Ethereum. He mentioned that updating routing and liquidity drastically improved the consumer expertise on the dApp, with the switch revert fee on V3 lowering by half when in comparison with V2.

“Additionally cool to see V3 transactions fail half as usually as V2, exhibiting the advantages of concentrated liquidity and all of the routing enhancements we made.”

Uniswap’s reputation made its mother or father firm a unicorn this 12 months. In September, sources near the corporate revealed that Uniswap Labs was making ready for a $100 million funding spherical to develop its providing. On the time, a number of media retailers speculated that the spherical would worth Uniswap Labs at $1 billion.

Nevertheless, the corporate’s $165 million funding round in October exceeded expectations and introduced its valuation to over $1.66 billion.