The distinction between success and failure in Foreign exchange / CFD buying and selling is very more likely to rely principally upon which property you select to commerce every week and wherein path, and never on the precise strategies you may use to find out commerce entries and exits.

So, when beginning the week, it’s a good suggestion to take a look at the large image of what’s growing available in the market as a complete, and the way such developments and affected by macro fundamentals, technical components, and market sentiment. There are some legitimate long-term traits available in the market proper now, which is perhaps exploited profitably. Learn on to get my weekly evaluation beneath.

Basic Evaluation & Market Sentiment

I wrote in my previous piece on 15th January that one of the best commerce alternatives for the week have been more likely to be lengthy of Gold in USD phrases and the EUR/USD forex pair, and in need of the USD/JPY forex pair additionally. Gold in USD phrases gained by 0.30%. The USD/JPY forex pair ended the week larger by 1.33%, and the EUR/USD forex pair ended the week larger by 0.21%. These trades gave a small common lack of 0.27%, so this was not a fantastic name general.

The information is at the moment dominated by a extra risk-on tilt seen within the markets on the finish of the week, with shares shifting a bit larger and the US Greenback virtually unchanged over the week. The primary occasion was the Financial institution of Japan’s coverage launch, which some analysts have been trying to for a hawkish shock, however in the long run the Financial institution maintained its full course of insurance policies. On Friday, the Financial institution of Japan governor Kuroda reaffirmed the Financial institution’s yield curve management measures and indicated a continuation of dovish financial insurance policies, sending the Yen decrease.

The opposite main information of the week was UK inflation fell barely as anticipated, however continues to be displaying an annualized charge above 10%, so the market is seeing extra charge hikes from the Financial institution of England, sending the Pound larger. Canadian inflation fell as anticipated.

Asian inventory markets ended the week principally larger, with the Hang Seng Index seeing its highest degree in six months, the Nikkei 225 Index rising, and the S&P 500 displaying indicators {that a} bull cross will most likely arrive inside the subsequent few weeks. A number of commodities are additionally rising. Forex noticed best energy within the New Zealand Greenback final week, with the Japanese Yen the weakest main forex.

Charges of coronavirus an infection worldwide once more dropped final week for the fifth consecutive week based on official knowledge, with the bottom general numbers seen since July 2020. Nevertheless, there are credible reviews suggesting tens of millions of recent infections after China’s “zero covid” measures have been not too long ago scrapped, and this week’s Chinese language New 12 months vacation is more likely to increase that. Probably the most vital development in new confirmed coronavirus instances general proper now’s taking place in China.

The Week Forward: 22nd January – 27th January 2023

The approaching week within the markets is more likely to see an identical or larger degree of volatility in comparison with the previous week, as there are some main knowledge releases scheduled together with the Financial institution of Canada’s month-to-month coverage report. The scheduled main releases, so as of significance, are:

- US Core PCE Worth Index

- US Advance GDP

- Australia CPI

- New Zealand CPI

- Financial institution of Canada In a single day Price, Price Assertion, and Coverage Report

- US Flash Providers PMI

- British Flash Providers and Manufacturing PMI

It’s a public vacation in China all week as a result of Chinese language New 12 months. It is usually a public vacation in Australia on Wednesday.

Technical Evaluation

U.S. Greenback Index

The weekly worth chart beneath reveals the U.S. Greenback Index printed a small doji candlestick, which generally signifies directional indecision. The low of the week rejected the help degree proven at 101.07, which is a destructive signal for bears.

We see the Greenback inside a long-term bearish pattern, with the worth persevering with to commerce effectively beneath its ranges of each 3 and 6 months in the past.

I don’t wish to commerce in opposition to long-term traits, so I’ll nonetheless look to solely be in trades that are in need of the buck this week. Nevertheless, there are indicators that the bearish pattern is now going to pause or make a deeper bullish retracement, so merchants must be cautious and be careful for this.

XAU/USD (Gold)

Final week Gold printed a small bullish near-doji candlestick which made the very best weekly shut seen since April this yr. The value additionally reached a brand new long-term excessive and closed above the excessive of final week – these are bullish indicators.

There are not any overhead resistance ranges close by, so the worth can most likely advance fairly simply to the large spherical quantity at $2,000.

Regardless of the near-doji candlestick, which may signify indecision available in the market, the technical image nonetheless appears bullish.

The value of Gold is more likely to proceed to rise this week.

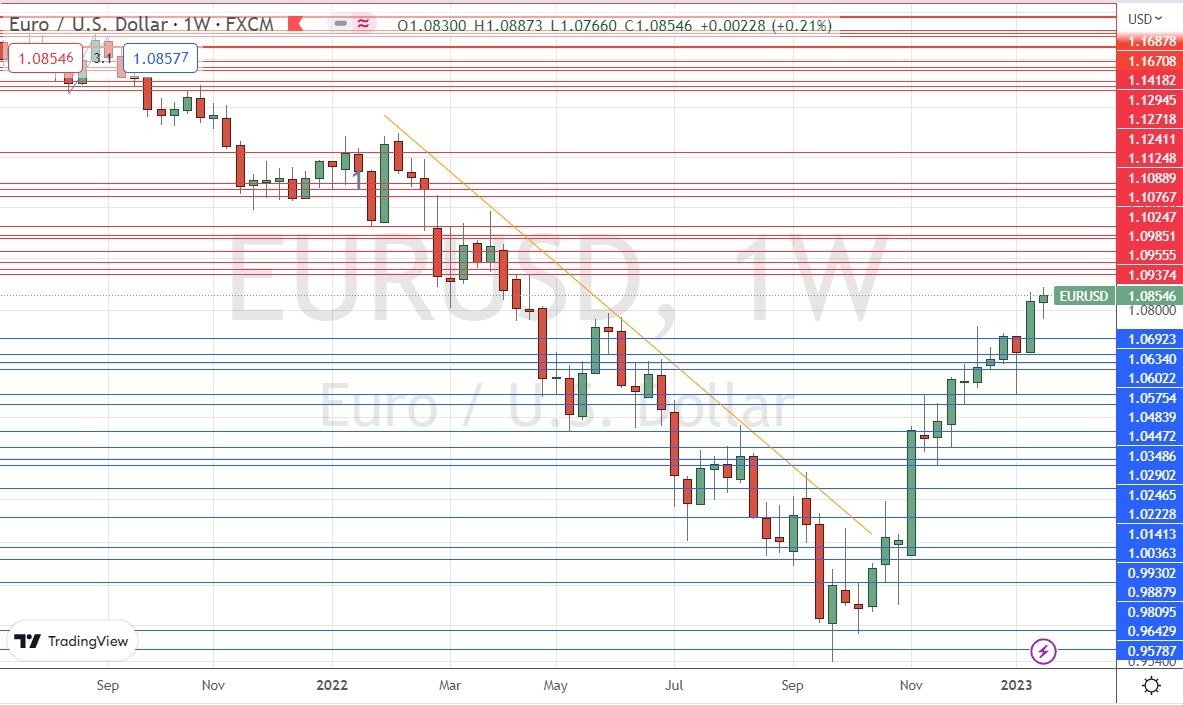

EUR/USD

Final week noticed the EUR/USD currency pair print a small bullish near-doji candlestick which made the very best weekly shut in ten months. The value additionally reached a brand new long-term excessive – these are bullish indicators, however it have to be mentioned the bullishness is wanting a bit weak

There are not any overhead resistance ranges close by, so the worth can most likely advance fairly simply to $1.0937 a minimum of.

Regardless of the near-doji candlestick, which may signify indecision available in the market, the technical image nonetheless appears bullish.

The worth of this forex pair is more likely to proceed to rise this week, consistent with its long-term pattern. Lengthy-term traits are statistically notably dependable on this forex pair.

GBP/USD

Final week noticed the GBP/USD currency pair print a large bullish candlestick which made the very best weekly shut in additional than seven months. The value closed close to the highest of the week’s vary, which is one other bullish signal, suggesting wholesome momentum within the British Pound.

The advance by the Pound was boosted by comparatively excessive UK inflation knowledge, at the moment sitting at an annualized charge of 10.5%, which is making the market suppose that the Financial institution of England can be very more likely to make additional charge hikes quickly.

The value of this forex pair is considerably more likely to proceed to rise this week, consistent with its long-term pattern. Nevertheless, bulls ought to be careful for the yearly excessive at $1.2437, which is more likely to act as robust resistance, a minimum of when first subsequent touched.

BTC/USD

The final two weeks have seen Bitcoin rise strongly, with above-average vary and closes very near the highest of the ranges. The value reached its highest degree since August after many weeks consolidating above $16k.

This can be a technically vital improvement and suggests the start of a brand new bullish long-term pattern, which has tended to be statistically fairly reliable in Bitcoin.

The primary factor bulls have to be careful for is the important thing resistance ranges at the moment sitting between $25,400 and $23,162 – it won’t shock me if this space halts the advance, a minimum of briefly.

Backside Line

I see one of the best alternative within the monetary markets this week as more likely to be lengthy of Gold in USD phrases and the EUR/USD forex pair.

Able to commerce our weekly Forex analysis? We’ve made a listing of the best brokers to commerce Foreign exchange price utilizing.