- Avalanche’s NFT ecosystem received excellent news as NAKAVERSE went multichain.

- Just a few metrics and market indicators had been in sellers’ favor.

Avalanche’s [AVAX] NFT ecosystem received excellent news on 23 January, which might assist the community register development within the discipline. Nakamoto Video games, a metaverse ecosystem, not too long ago introduced that NAKAVERSE was poised to go multichain. They started by integrating NFTs with Dogecoin [DOGE] and would quickly add different networks, together with Avalanche.

The #NAKAVERSE will combine #NFTs from all main #Web3 #Protocols.

Beginning with $DC 🐶and $REEF 🪸, adopted by $TRX, $SOL, $AVAX, $BNB, $DOT and $ADA.

That is a part of our $NAKA Imaginative and prescient to make Nakamoto Video games a central #Web3 Gaming Hub 🔥 #Buildinghttps://t.co/5J722SwYaA

— Nakamoto.Video games (@NakamotoGames) January 23, 2023

Learn Avalanche’s [AVAX] Price Prediction 2023-24

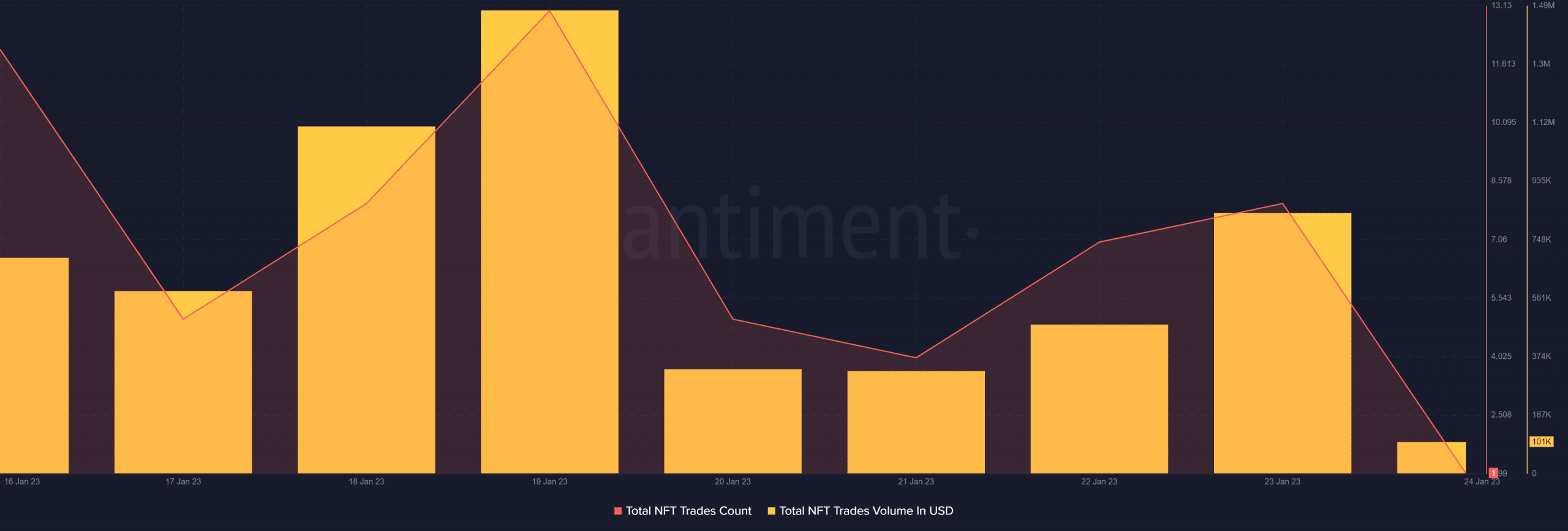

Nonetheless, Avalanche’s efficiency in its NFT area was not on top of things. Santiment’s chart revealed that AVAX’s complete NFT commerce counts and complete NFT commerce quantity in USD declined over the past seven days.

Other than the NFT area, Avalanche validators additionally received a brand new alternative. DeepSquare, which is a decentralized cloud computing ecosystem, revealed that it was on the lookout for 10 Avalanche validators to validate DeepSquare’s subnet.

Are you an #Avalanche Validator and wish to validate @DeepSQUAREio‘s Subnet? That is your second!

Discover all the small print on tips on how to be part of our grid!#AVAX #CloudComputing #Subnethttps://t.co/cRiiRKIRJO

— DeepSquare.io 🔺 (@DeepSQUAREio) January 23, 2023

How has AVAX been?

AVAX has been making its buyers smile for fairly just a few days now by registering promising beneficial properties. CoinMarketCap’s data revealed that AVAX’s worth elevated by 8% within the final seven days, and at press time, it was buying and selling at $18.33 with a market capitalization of over $5.7 billion.

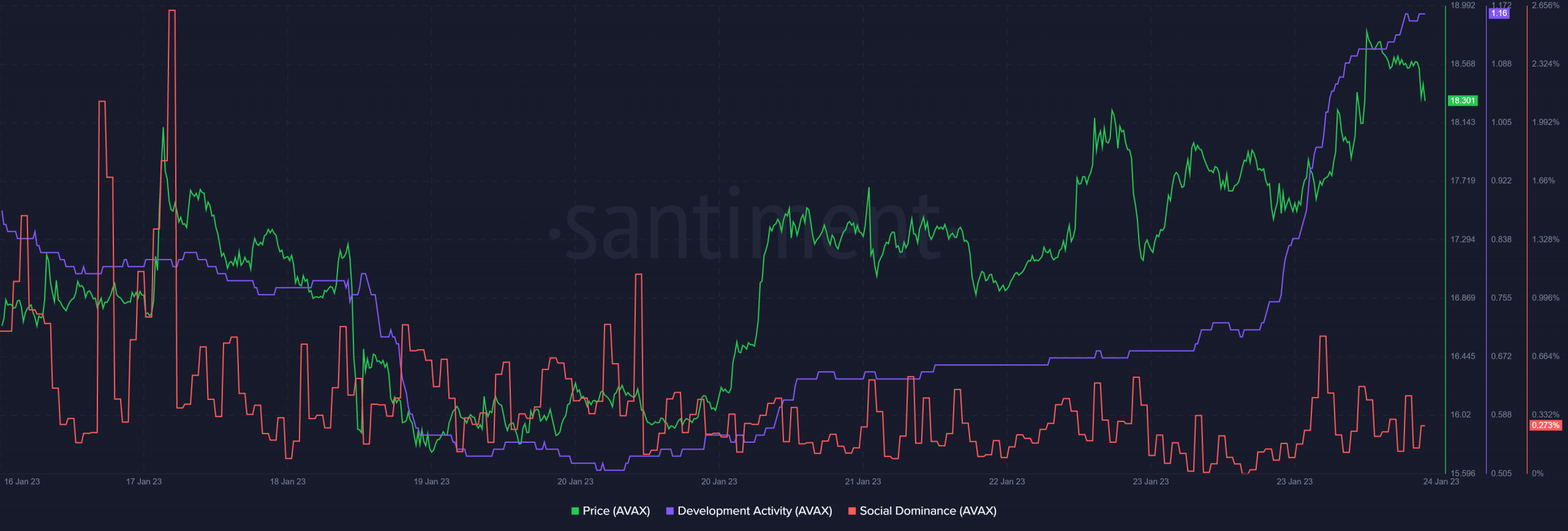

Nonetheless, AVAX failed to stay well-liked within the crypto group, as its social dominance decreased over the previous few days. Nonetheless, as per LunarCrush, AVAX elevated its market dominance. AVAX’s growth exercise additionally moved northward, which was a optimistic sign.

Real looking or not, right here’s AVAX market cap in BTC’s terms

Bother is across the nook

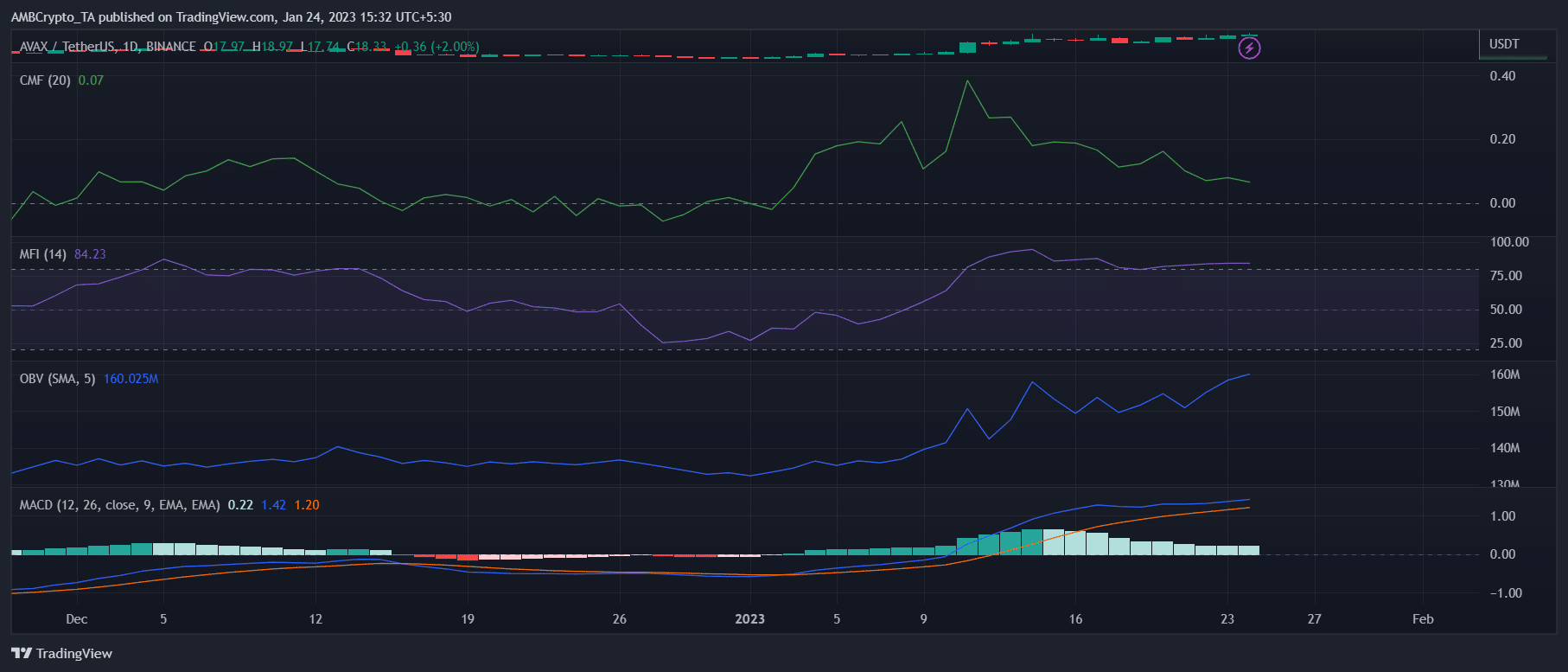

Just a few market indicators urged that the bears had been going to take over management of the market. The MACD displayed the opportunity of a bearish crossover, which might trigger a worth drop. AVAX’s Cash Circulation Index (MFI) was within the overbought zone.

The Chaikin Cash Circulation (CMF) additionally registered a downtick, which was a transfer within the sellers’ favor. AVAX’s On Steadiness Quantity (OBV), nonetheless, remained bullish because it went up.